Our 2019 Growth Index reveals that fast growers (30%+ YoY revenue growth) take a strategic approach to pricing to drive 75% higher average selling prices (ASPs). How? The answer is two-fold. First, they use multiple pricing levers to communicate and capture value. Secondly, they are disciplined about setting and adhering to pricing floors aligned with customer segmentation. Here's the rundown:

Four Pricing Levers for Higher ASPs & CLTV

Strategic pricing models assign a primary unit of value as a foundational element, and then layer components -- or what we call levers -- to create dimension for additional value. The primary unit of value is commonly the underpinning of strategic goal-setting for the business -- often the basis of a North Star metric, to which all employees have accountability through supporting KPIs cascaded throughout the organization.

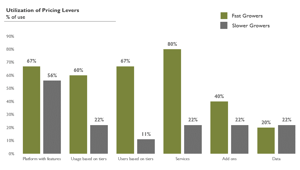

In this year's report, we highlight several options for getting more leverage from your pricing and packaging model in the interest of capturing greater value when both landing and expanding accounts. Fast growers achieve higher ASPs and CLTV using an average of four pricing levers, while slower-grower peers use only two. What we also know about these fast growers is they have proven product-market fit and employ product roadmap discipline and prioritization practices aligned with their pricing models.

The chart on the right illustrates which levers are utilized by fast vs. slower growers. The majority of this year's fast growers charge base platform fees (packaging commonly stratified based on feature set), combined with usage or user fees based on volume, as well as add-on feature-based modules. 80% of fast growers also charge fees for implementation, integration, onboarding and training related services.

Pricing Floors are a Faster Grower's Friend

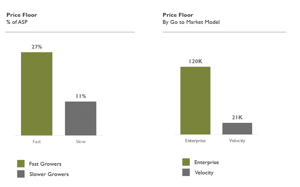

Establishing a pricing floor is important to achieving sales repeatability and customer profitability, but needs to done with a keen understanding of your Ideal Customer Profile (ICP), segmentation, the value your product delivers to and what it takes to acquire each customer type. For example, enterprise software companies with complex (i.e., high CAC) selling cycles typically cannot afford pricing floors of less than six figures.

Per the chart on the left, this year's Growth Index tells us that fast growers set pricing floors that are 27% of their ASPs. Those fast growers with enterprise go-to-market models have floors >2x higher than slower growers with the same model and, those with velocity go-to-market models have >1.5x higher floors.

So, there you have it, two pricing related methods adopted by Edison's fast growers. For more top-line and bottom-line characteristics of fast growers, download our 2019 Growth Index.

.png)