The new year is fast approaching and, no doubt, you are working to tie up loose ends with your 2018 growth plan. Are quotas high enough? Should we be raising prices? What more can we do to boost gross margin? How can we get more contribution from Marketing dollars? When will 1Q18 hires have impact?

As you put the finishing touches on that budget, consider "Oh, the Places You'll Go Grow" with these eight characteristics of Edison's fast growers from this year's Growth Index. (Clever rhyming a la Dr. Seuss excluded.)

1. Fast Growers Spend >2X More in Sales and Product. Fast growers incur greater losses and spend more in every OpEx category, but how they allocate budget differentiates them. Product and Sales are top expenses for fast growers -- 78% of revenue, compared to 30% for slower growers. Fast growers also tend to have better control over their COGS, creating more opportunity to flex spend in the areas that drive revenue.

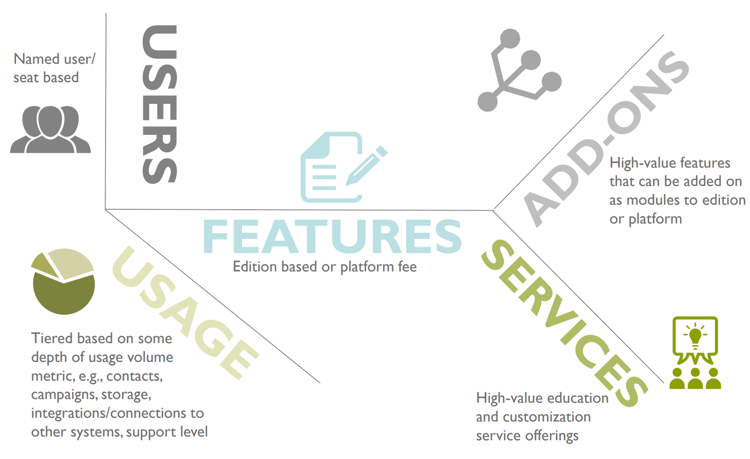

2. Fast Growers Enjoy an Average Selling Price (ASP) that is >2X Higher than Slower Growers. These companies make use of multiple pricing levers to drive up ASP and maximize organic and expansion growth.

Those who have not yet evolved beyond simple edition or seat-based pricing are missing an opportunity to capture more value per customer. Likewise, add-on services offerings beyond standard implementation, such as high-value training and customizations, are an opportunity to drive up ASP, and commonly offered by fast growers.

3. Fast Growers have Faster CAC Recovery. Fast growers' customer acquisition investments have a median CAC payback period of 15 months. Companies with best-in-class CAC recovery rates like this tend to have a keen focus on:

- Attribution (best sources of demand for volume, velocity and value)

- Repeatability (segments, sectors, selling disciplines, price points)

- Alignment (between marketing, sales development, sales & product)

Important, because the longer it takes to recover CAC, the worse it is for cash flow.

4. Fast Growers have Strong Negative Working Capital. Even when fast growers invest in the right areas, they can expect to incur significant losses. The old adage applies: You have to spend money to make money. However, not all losses are viewed the same – there’s a difference between GAAP losses and cash burn – and there are tactics for combatting significant losses.

The number one thing companies can do to combat CAC’s impact on cash flow is collect payment upfront, and incent advance payment for multi-year contracts. This enables the receipt of more cash than recognized as revenue, and provides a realistic view of cash flow runway.

Fast growers have higher EBITDA loss ratios, but they control it by targeting a negative working capital position. This involves using the excess cash, e.g., from prepaid contracts, to fund expenditures that the company would not otherwise be liquid enough to fund.

Our companies have found that deploying the appropriate accounting software can also aid in better capital management. While sufficient in the early stages of company growth, QuickBooks should be phased out as companies cross the $10M revenue threshold.

5. Fast Growers Derive Growth from Talent Expansion and Productivity. It is logical that a correlation would exist between growth rate and change in headcount, but which drives which? We've found there to be a weak correlation between 2015 hiring and 2016 growth, but when looking at 2016 hiring and 2016 growth, the correlation is strong. Given that growth rate is derived from GAAP Revenue (a trailing metric), it can be concluded that hiring is following visibility into growth, i.e., bookings.

We also found that companies with in-house recruiters hired 41% more employees, but they also spent more on external recruiting fees. A surprising finding, as in-house recruiters are expected to not only speed hiring, but also reduce the cost of hiring. We recommend that companies hiring 20+ employees annually bring recruiting in-house and handle the bulk of recruiting in-house. In the event outsourcing is needed, the recommendation is to leverage for only two of every five hires, and to pay no more than 20% in fees for non-exec hires.

6. Fast Growers are Better at Setting Sales Quotas and Achieving Them. Fast growers with enterprise/field models outpaced those with velocity/inside models on quota attainment. And fast-growing Martech companies come closer to hitting quota than companies in other sectors.

Fast growers mitigate risk by ensuring a minimum of 120% quota coverage, and ideally, managing to 130-140%.

If/when there’s insufficient quota coverage, companies often jump to hiring more sales reps. Sometimes, this can be the right answer, but fast growers also know to consider the following:

- Marketing Contribution – Are programs delivering the required pipeline volume and value?

- Sales Development Coverage – What is hindering SDR production? Are better productivity tools needed? Do more SDRs need to be hired?

- Individual Rep Goals – If quotas were higher, would they still be attainable, particularly with greater Marketing and SDR contribution?

7. Fast Growers Maintain Healthier Gross Margins. Companies maintaining high gross margins are true software companies, primarily SaaS companies emphasizing software product revenue over lower-quality service revenue. Companies with SaaS-level margins (>70%) are also those incurring more hosting costs than COGS related labor costs, i.e., customers are paying for product, not people.

Fast growers give special attention to simplifying product, limiting services dependencies where possible, and reducing hosting costs -- all key contributors to driving up gross margin.

8. Fast Growers Retain Dollars at Higher Rates and in a Net-Positive Way. Perhaps the best indirect method for driving up gross margin is customer retention. New customers require substantially more support than longer-term customers. Logically, Edison fast growers not only have lower churn than slower growers, but they have strong net dollar retention.

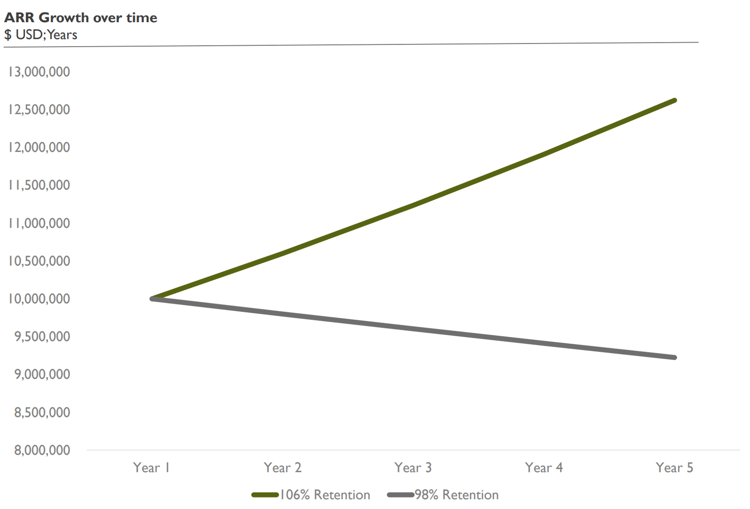

We found there to be an 8% delta in retention rate between fast growers and rest of the Edison portfolio. This may not seem significant on the surface, but it can have a meaningful impact over time.

Consider two companies with $10M ARR and retention rates of 106% and 98%. After one year, the ARR bases grow/shrink to $10.6M and $9.8M, respectively. Three years later, those ARR bases turn into $12.6M and $9.2M. This doesn’t take into account new business that will increase that gap further. Now, consider your customer’s lifetime. If you intend to keep your customers for 4+ years, you can expect a 37% lift with only an 8% increase to net retention.

Fast growers have a keen focus on customer success and programs that drive retention, lower the cost of support, and ultimately, boost lifetime value. (More on best practices for improving customer retention can be found in Got Churn? 8 Questions Your Organization Should Be Asking Itself.)

So, there you have it, eight traits for your business to emulate to accelerate growth in 2018. For more data, analysis, benchmarks and insights on these traits and other growth factors and dynamics, download the Edison Partners Growth Index. And watch for our 2017 Index in March/April 2018.

.png)