This article was originally published on Terminus' #FlipMyFunnel Blog, October 31st, 2017.

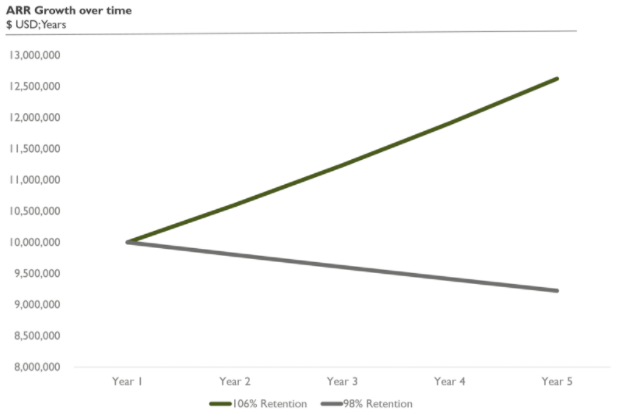

Retention is the leading indicator of a business’ health and potential. As investors in high-growth SaaS businesses, we, at Edison Partners, like to see MRR churn rates of <2% monthly and, ultimately, net dollar retention of >100%, meaning expansion revenue from existing customers is greater than the lost revenue from churned customers. Last year, our fast-growing companies (30+% growth) averaged 106% net dollar retention, while companies growing at lower rates averaged 98% net dollars retained. Not bad, right? Well, an 8% delta in retention rate may not seem significant on the surface, but it can have a meaningful impact over time.

To illustrate this point (see above chart), consider two companies with $10M ARR and retention rates of 106% and 98%. After one year, the ARR bases grow/shrink to $10.6M and $9.8M, respectively. Three years later, those ARR bases turn into $12.6M and $9.2M. Now, consider the customer lifetime (CLT); keeping your customers for 4+ years could mean a 37% lift with only an 8% increase to net retention.

Don’t get me wrong. New bookings growth matters too, but if a business has not yet figured out the formula for keeping the customers they already have, retention needs to take the front seat. If this sounds like your business (perhaps your MRR churn is >2% monthly), ask yourself the following eight questions. And if your monthly churn is <2%, congratulations (!); no doubt your organization has great answers to these questions, but there still may very well be something here for you, too.

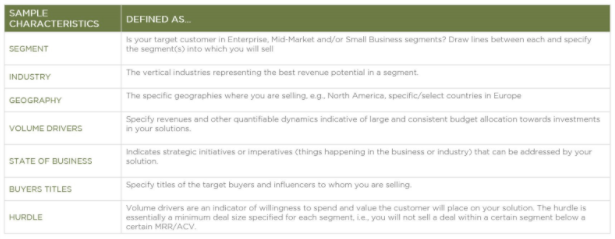

1. Are you selling to your ideal customer profile?

This is a go-to-market alignment question and a critical factor in driving customer retention. Defining and aligning on your ideal customer profile (ICP) focuses the entire company on the right buying organizations at the account level – the ones that derive the most value from your product and are willing to pay for it. Your ICP should consider the following characteristics, at minimum:

Terminus is laser-focused on aligning its organization around ICP. They use filtering and AI-assisted scoring to focus marketing programs and prospecting efforts on only high-fit accounts based on ICP criteria, then prioritize and trigger plays off of intent and engagement indicators. By crystalizing the company’s ICP and optimizing demand generation and sales development practices accordingly, Terminus has realized a 48% and 35% lift in demo-to-interest and interest-to-win conversion rates, respectively, and deal size is up 20%. Downstream, this focus on ICP fit will also drive improvement in account retention.

2. Is your pricing model aligned with the value customers realize from your product?

If contract value outsizes consumption and/or outcomes derived from use of the product, then customers will churn. Value-based pricing models help to ensure customer usage aligns with price. In the marketing automation platform (MAP) space, for example, a common unit of value measurement is contact volume. Most, if not all, MAPs package and price their good-better-best editions based on the number of contacts in the system (among other value levers). MAP vendors know that if a customer is paying $5k/month for a package that includes thousands of contacts, and the account is not adding a high volume of contacts through inbound lead generation campaigns or account/contact discovery, it is likely at risk to down-sell or, worse, churn.

A great example of a company that has recently had success shifting to a value-based pricing model is Axial, a deal network that helps middle market companies raise equity, find a lending partner, or sell their business. Their model is based on the desired number of deals a financial or corporate buyer would like to source from the network. As contact volume is to MAPs, deal capacity is to Axial. Deal capacity is the company’s lever for right-sizing and retaining its customers.

Building this sort of value lever into your pricing model is highly recommended for driving up both retention and lifetime value.

3. Do you have a definition for account health?

To be maniacal about customer health, there needs to be a definition of customer health that is shared, understood and institutionalized (read: driving behavior) across the company. One or more health metrics correspond with attributes you know result in a successful customer, or conversely, a customer at risk of churning.

LookbookHQ is a shining example of a company that is maniacal about customer health. Customers of the company’s intelligent content platform are considered in good health when they a). are consistently driving traffic to content experiences and b). building new “lookbooks” in the last 30 days. CSMs look for spikes (up and down) and pay close attention to patterns based on customer goals.

Per the MAP and Axial pricing examples above, it is common for the unit of value (for your customer and your business) associated with product usage to be an indicator of account health. Likewise, Net Promoter Score (NPS) is a great proxy, and a reliable measure of loyalty. Businesses that adopt NPS have proven to experience lower churn than those who don’t.

Other metrics/factors to consider:

- Login frequency

- Feature adoption (integration/API modules, for example, tend to be sticky features)

- Support incident volume

- Level of engagement with customer marketing communications

- Strength of the company executive and CSM relationships with key stakeholders

- Level of advocacy (testimonials, press reference, customer reference, speaking circuit)

Bottom line: If you are not measuring and monitoring indicators of account health, then your customer marketing and success practices are flying blind, which brings us to question #4.

4. Do you tailor your customer success practices?

Hopefully, your customer success organization has a single mission – retention. Too often, companies load up CSMs with retention AND expansion objectives. Each requires distinct skillsets and practices, and frankly, I have never seen a CSM be successful at tackling both.

Distinct customer segments tend to require their own customer success practices, too. Few businesses can successfully serve a mix of $20k ARR accounts and $100k ARR accounts with the same CSM because greater contract value often means greater complexity and sophistication. To achieve a recommended target of $2M ARR per CSM (at scale), there needs to be a repeatable set of practices tailored by account segment. This means delineating between practices designed for CSMs managing 100 $20k ARR accounts, vs. those managing 20 $100k accounts. The former speeds time to value and reinforces value throughout the customer journey on a one:many basis, while the latter is a more tailored, prescriptive, 1:1 approach.

Regardless of segment, cadence is critical – both the cadence of evaluating health based on the data available, as well as engaging the customer based on what the data is telling you.

5. Are customers asking you for product improvements that are not being met?

If your product is not evolving fast enough to keep up with customer needs, then your customers may leave you for a competitor out of dissatisfaction. Internally, the root cause of product delays could be people, process or tech related – or worse, cultural. What I mean by cultural is that your product and engineering teams may not be customer minded, or customer driven.

Customer-driven product teams:

- Are agile in their delivery of product that solves customer problems.

- Spend time with customers to understand their daily use of the product.

- View the folks who spend the most time with customers (sales, customer success, support, professional services) as their internal customers, and share goals with those teams.

- Are empowered to improve products based on customer success metrics.

- Are accountable for improving products based on customer success metrics, i.e., a component of their compensation is tied to improving those metrics.

When customers don’t feel heard and release schedules slip, step back from that last customer complaint to consider the bigger picture and potential of a customer-driven culture.

6. Are you easy to do business with?

As mentioned above, data-driven, proactive customer success practices and being responsive to customer feedback play a big role in delighting and retaining customers. Offering frictionless experiences do, too, particularly through support and contract related processes.

Following are some ways to ensure you are making an “easy to do business with” impression:

- Clearly state customer support hours of operation

- Provide multiple contact options for support, including live chat for real-time access (not to mention, efficiency)

- Set and meet (exceed) expectations for customer support response time

- Set and meet (exceed) expectations for time to issue resolution

- Offer 1-2-page click-through contracts and/or enable e-signatures for renewals (heck, make this happen for the initial deal, too)

And to the extent you are able, keep apprised of how your competitors are handing all of the above.

7. What is your practice when there is a new point of contact (POC) at the account?

Reorgs, reductions in force (RIFs), an offer elsewhere that couldn’t be refused… you know the drill; all of the above can throw a wrench into what might have otherwise been a healthy, likely-to-renew account. Being in the know is job one. If your organization’s relationship with the original POC is strong, then you will likely be in the know. For accounts with weaker links, CSMs should make it a regular practice of combing LinkedIn for changes throughout the original buying committee, and even throughout the active user base.

There is a high cost of inaction in these situations. The new POC will need to be treated as if he/she is becoming a customer for the first time – onboard him/her, align on goals, provide training. As part of goal alignment, try to hone in on whether the new POC stands to benefit personally from continued and successful use of your product, e.g., can you make him/her a hero? Your new POC’s personal gains are likely to outweigh any risk.

8. Are your customers paying upfront for their annual contracts?

Some businesses find late payment to be an indicator of potential churn. This may very well be the case, but, if yours is a business with a true annual subscription model, you are well served to collect payment for the subscription upfront. Advance payment not only helps with cashflow, but also has proven to combat churn. Why? Because customers who pay in advance have a greater commitment to the product/service and successful adoption of it.

Certainly, there are more than eight questions that can help recurring revenue businesses combat churn… and everyone loves a top 10 list, so let’s complete this article, shall we? What are the two additional questions that should be included here? Would love to hear from you at @KellyAFord or kford@edisonpartners.com .

.png)