If you’re familiar with Edison Partners, then you know that we believe the board of directors should be the company’s secret weapon. This especially applies to the exit process, as the board plays a key role in ensuring that it is both smooth and effective. In fact, board members have a fiduciary duty to ensure any transaction pursued is in the best interest of all shareholders, and will work with the CEO, management, and banker to drive the best possible outcome for the company.

Key Areas of Focus

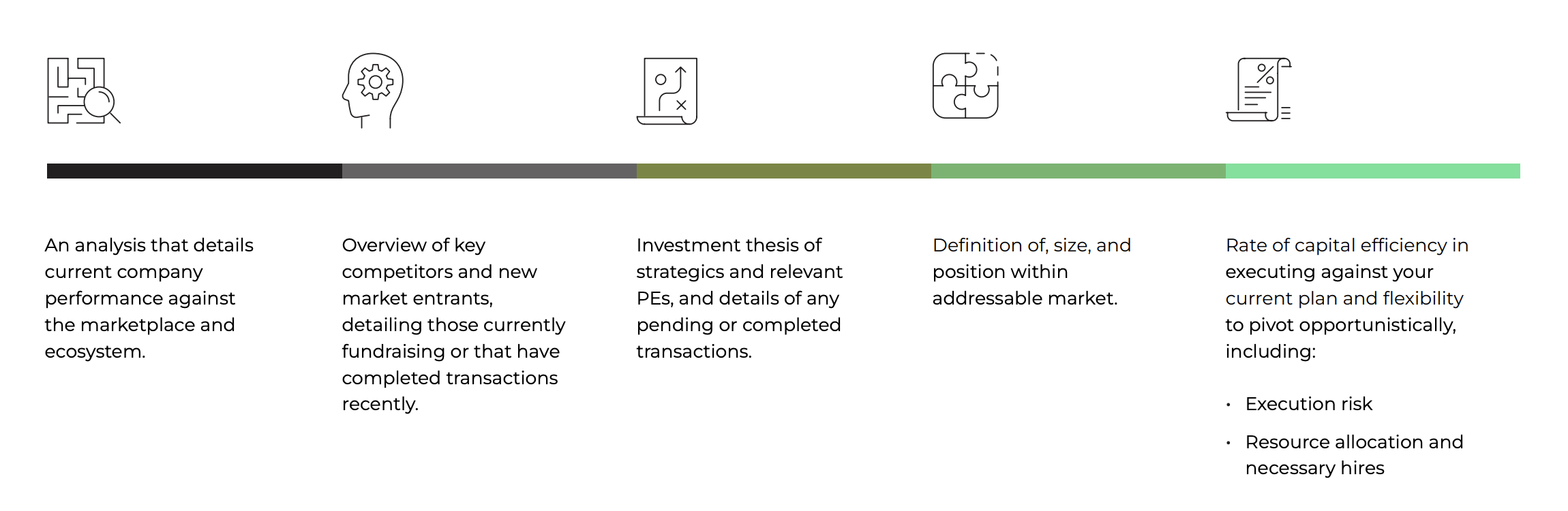

It is best practice to include exit planning as a standard board agenda topic, especially when inside 18-24 months of a potential process. Board members should provide ongoing feedback on a standard framework prepared by the CEO and updated quarterly to include:

- Company performance: The board should regularly analyze the company’s performance against industry benchmarks. Potential buyers will want to see that the company is outshining – or at least on par with – its competitors.

- Competitive analysis: You can’t beat the competition without knowing who they are. Board members must stay abreast of the competitive landscape: new market entrants, recent transactions, etc.

- Investment thesis: The board should be just as informed as the CEO and banker about what types of buyers would make a good fit for the company and conduct ongoing research into the types of deals these buyers are making.

- Market position: It is critical for the board to understand the company’s position in the addressable market and advise the CEO and management team on how to strengthen that position.

- Capital efficiency: Board members should analyze both the costs associated with the current exit plan and the company’s ability to pivot if needed. It is important to assess execution risk, resource allocation, and potential hiring needs.

The Role of the Independent Lead Director

The lead board director is perhaps the MVP of the exit process; ideally, she or he has exit experience and can offer well-informed advice on both preparation and execution. The lead director has several key responsibilities, including:

- Driving alignment across the board throughout the transaction process, serving as an advisor to all board members.

- Ensuring all board members agree on success criteria and deal terms from the outset of the process.

- Leveraging their network for banker referral and selection.

- Ensuring that the company and CEO have the resources to stay on track operationally while conducting a process.

- Ensuring maximum value for common stakeholders.

Beyond the lead director, other board members should remain engaged in the process. You might even decide to establish a special sub-committee to ensure the transaction gets the detailed attention it deserves from the most objective parties.

Never underestimate the power of an engaged and proactive board, one that strategically partners with the CEO and management team to drive company success. When the board prioritizes exit readiness early on, it sets the stage for a transaction that meets and exceeds all shareholder expectations. Remember, the best time to prepare for an exit is long before the process begins. Make sure your board is ready to be your strategic weapon when the time comes.

.png)

.png)