As a growth-stage CEO, there are few things more exciting (and, perhaps, anxiety-inducing) than the moment you realize a potential liquidity event could be on the horizon. Delivering optimal value for your stakeholders is paramount and it pays to be prepared.

At Edison, we have decades of experience working with companies from investment through recapitalization and exit. Of course, every process is different; however, many of the fundamentals remain the same. If the next transaction is on your mind, then start here.

Getting Ready

The first step is to do some due diligence of your own: talk with your board of directors, gather input from the market and other investors, and speak with investment bankers. When you’re finished, ensure you can answer these questions:

- Is now the right time to sell?

The answer may not be as straightforward as you’d expect. First and foremost, having company-investor alignment is critical to ensure the timetable lines up across business performance and forecasts and the investor’s investment thesis and potential fund dynamics. Secondarily, macroeconomic factors should be considered, both with respect to the broader deal environment and your specific customer end-market(s). While timing the market is different, being aware of supply and demand balances could help or hurt your chances of optimizing the outcome more than you think.

- To whom should you sell?

What type of buyer would make the best fit for your company, in terms of both willingness to pay and culture? Determining whether this is the final liquidity event (a true exit) or the start of the next leg of the journey may affect your priorities and, ultimately, your answer. After all, a transaction with a strategic acquirer will look different than that with a financial buyer, and an IPO is a different beast entirely. Each comes with its own deal structure and financial expectations, cultural implications, and reporting and regulatory guidelines.

- What is your story?

The way you position your company makes all the difference during the process. You should be able to clearly convey your company’s value proposition, competitive differentiation, market position, and strengths and weaknesses, with one eye in the rearview and the other on the opportunity to come.

Key Considerations

Once you’ve formed perspectives on these questions, in order to set you and your team up for a greater probability of success, you’ll want to consider the following seven actions before you begin an exit process:

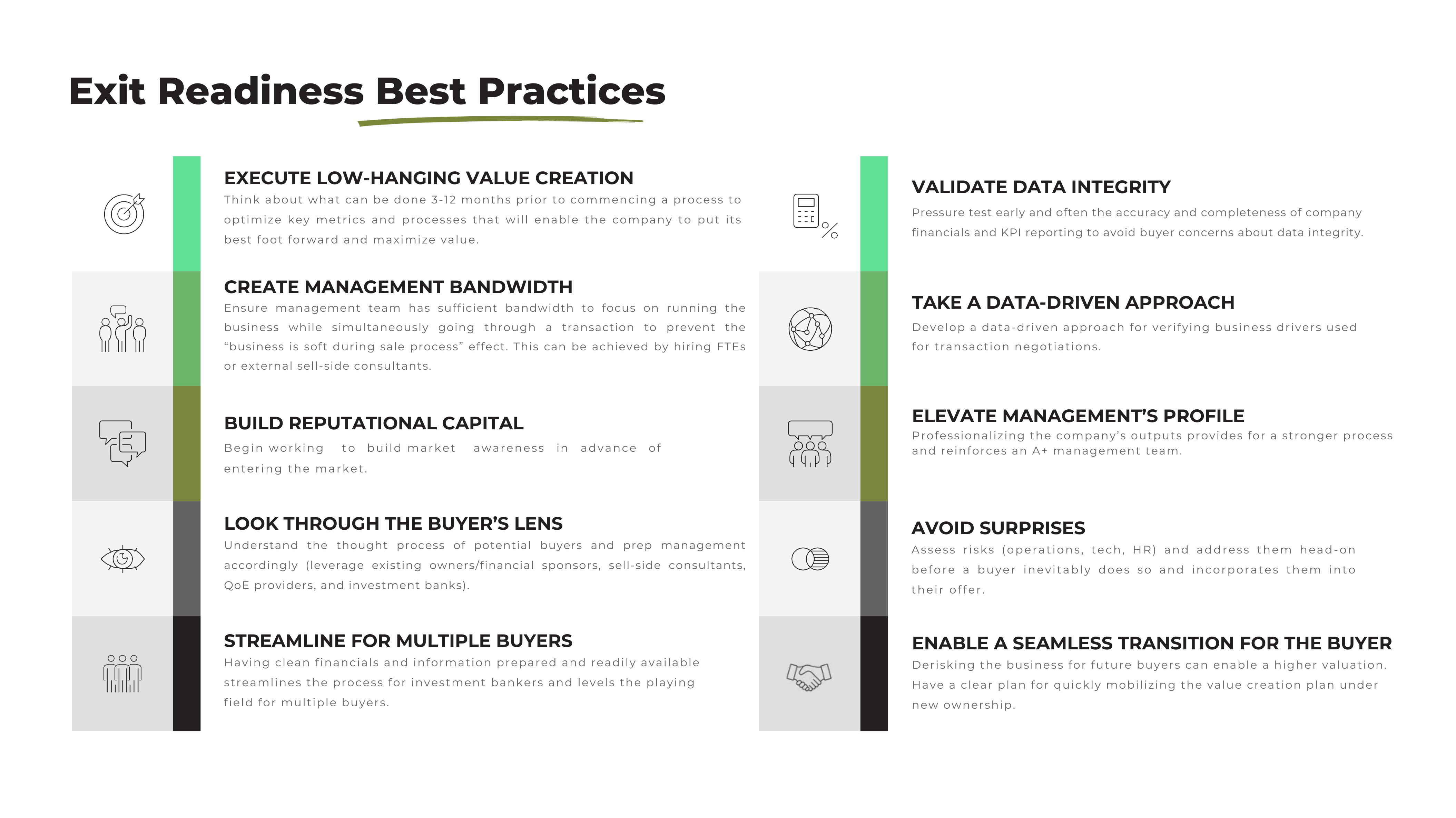

- Execute low-hanging value creation. What can be done 3-12 months prior to commencing a process to optimize key metrics and processes that will enable the company to put its best foot forward and maximize value? Examples: intentional churn efforts to refocus business on ICP and profitable accounts; margin expansion initiatives such as centralizing procurement and cross-selling products; contract restructuring to enhance working capital dynamics; and/or credit facility refinancing to improve cashflow.

- Create management bandwidth. Your management team must have sufficient bandwidth to focus on running the business while going through a transaction to prevent the “business is soft during sale process” effect. This can be achieved by hiring the necessary resources in advance or contracting with external sell-side advisors.

- Build reputational capital. Begin working to build brand awareness in advance of entering the market. This includes attending industry conferences, proactive PR initiatives, refining the company’s presence on review sites, updating customer and employee NPS scores, etc. We will dive into what to do and how to do it in a later blog. In the meantime, my partner, Kelly, wrote a great article that serves as a nice primer.

- Look through the buyer’s lens. Take time to understand what potential buyers care about and will ask for, and prepare management accordingly. Develop a data-driven approach for verifying answers to quantitative questions. Leverage existing investors, sell-side consultants, QoE providers, and investment bankers to enhance credibility.

- Validate data integrity. Pressure test early and often the accuracy and completeness of company financials and KPI reporting to avoid buyer concerns about data integrity. Having data requests readily available will also streamline the process and will level the playing field for multiple buyers, creating incremental competitive tension. Taking care of this up front will also save your team valuable time down the road.

- Elevate management’s profile. Your management team is just as much a representative of the company as your CEO. Involving more people creates operational leverage across the organization, showcases your A+ management team, and tells buyers that key man or woman risk is mitigated.

- Avoid surprises. Assess risks (operations, tech, HR) and address them head-on before a buyer inevitably does so and incorporates them into their offer.

In summary, you can never be too prepared for a fundraising or an exit process and the work to get ready should start early. While you may choose to enlist the help of one or more advisors (more on that in our next blog), it is ultimately up to you to ensure that your company is prepared.

Stay tuned for the rest of this blog series, where we’ll share more insights and resources to help you get exit ready.

.png)