As a data-addict, I look forward to our Growth Index every year as it always spurs a handful of new insights on what accelerates, or restrains, growth in our portfolio companies. There were a bunch of interesting topics in this year's report, but one that captured my attention was the evolution of headcount across the stages of company growth.

A key takeaway from the study was that fast growers hire quicker than slow growers. However, I thought it was interesting to go one level deeper, and dig into the types of hires each type of company made, and when they made them. Here’s what the data showed…

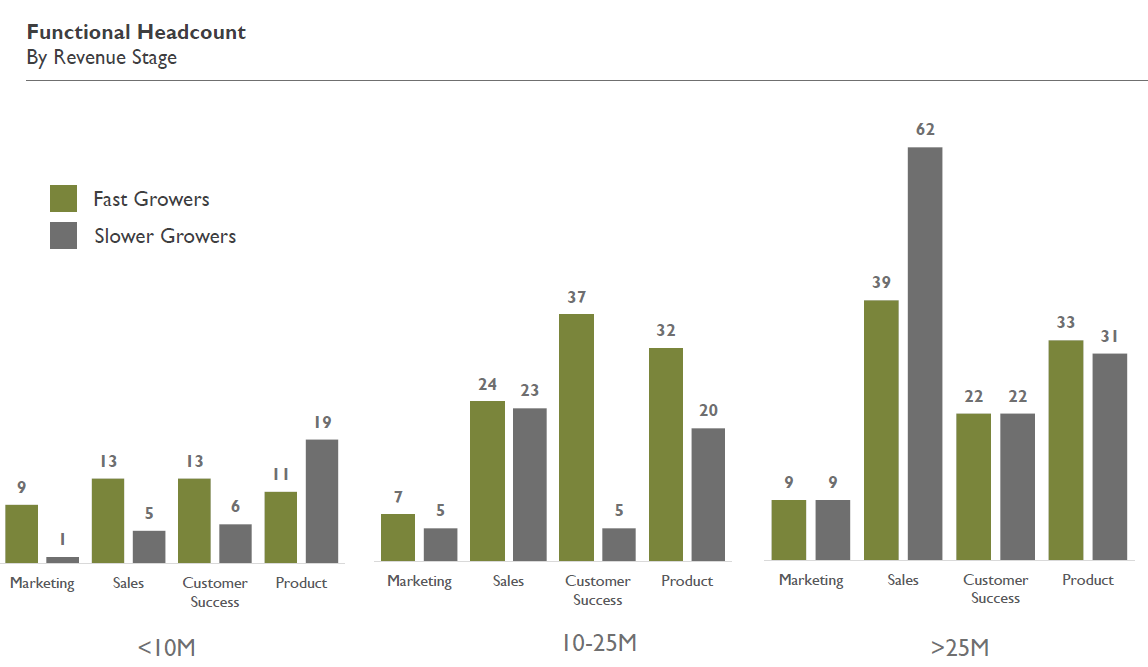

<$10M ARR: Fast growers at this stage tend to over-index on Sales and Marketing hiring, versus their slower grower peers. Perhaps not terribly surprising, but what stood out was the dramatic delta by which they over-indexed, to the tune of 3-4X more heads than slower growth companies. Similarly surprising was how much more attention they paid to Customer Success (on average 2X more headcount) versus slower growers. The superpower of fast growers is their ability to drive strong net retention so that the burden of growth is not driven just by hiring more reps. That seems clearly proven out at this stage of company growth.

There was also a significant diversion in Product hiring, with slower growers tending to hire much heavier at this stage, to the tune of almost 2X the faster growers. While getting the product right and building moats are obviously very important at this stage of company growth, it’s important not to invest in tech blindly and lose sight of what is driving commercial success in your business.

$10-25M ARR: Now we see the differences in investment becoming smaller as Go-To-Market (GTM) becomes more mature and the product-market fit solidified. Both fast and slower growers have roughly similarly sized Sales and Marketing orgs, although not surprisingly both are much larger than at the <$10M stage. What is interesting is that the fast growers have kicked their Product hiring into gear, and on average have 50% more heads than slower growers. The slower growers have largely kept their Product headcount flat at this stage and focused most of their efforts on scaling up Sales and Marketing. Overall however, the largest delta is in Customer Success. Slower growers have kept the size of their organization relatively static; however, fast growers way over-index on their hiring in this function, growing it almost 3X larger than at the <$10M stage, and investing at the rate of 7X of slower growers.

Edison Partners 2019 Growth Index

$25M+ ARR: At this stage, the playbooks for many of our companies look largely the same. However, there is a dramatic difference in sales efficiency, with fast growers seeming to have figured out how to drive growth while employing fewer heads in Sales. While the data here is probably skewed somewhat by the size of the data set (fewer companies in our portfolio at the $25M+ level), it is directionally correct.

So what does this all mean? Well at the risk of drawing broad insights from a single set of data, I’ll try to distill a rational story supported by the data.

Edison Partners 2019 Growth Index

At early stages of organizational maturity, our fast growers consciously prioritized GTM (Go-to-Market) investments over Product/Tech. We can see a stark difference in company-building philosophy, with an element of “build it and they will come” in our slower growers and a focus on getting out in front of customers in faster growth companies.

As the companies begin to mature, it looks like the slower growers are now playing a bit of catch up. They have to hire more heavily on GTM to continue to drive growth, but don’t have enough operating budget left to continue scaling their Product function. And, at this point, they are not really focusing on Customer Success as a key driver of their business. We can postulate that an under-investment in GTM in its earlier stages has likely left these slower growth businesses more resource starved and cash poor by this point, making it more difficult to continue to scale across functional areas.

On the other hand, the fast growers who invested more in GTM upfront now have the financial resources to more than catch-up in their Product investment, but also continue to grow their GTM function. In addition, they are able to double down on Customer Success, recognizing the financial value of retention and upsell. While product roadmap and tech build-out may have suffered in early stages due to the relatively lighter investment, these companies can now afford to invest heavily in Product and R&D as they have a stronger growth engine to support increased operating budget.

Finally, as these businesses reach escape velocity, they’ve largely solved for most of the issues in their businesses and are on a pathway to success. However, the faster growers who have learned more about their commercial model along the way are significantly more efficient in their GTM strategy. They can drive higher growth with fewer sales reps once at scale, which should provide them long-term advantage against challengers in their market.

TLDR; Emphasizing Sales, Marketing, and Customer Success over Product early on in the life of your company has long-term “health benefits” that will pay dividends through all future stages of growth.

Agree, disagree? We would love to hear your own interpretation of the data – please drop us a note with your thoughts!

.png)