Edison & Portfolio News

February 18, 2026

Payra and Edison Partners Announce $15M Growth Investment to Modernize Accounts Receivable for America’s Heartland Businesses

New capital to accelerate ERP-native payments and Cash Application automation for construction, industrial, and blue-collar suppliers opera...

February 11, 2026

Edison Partners Named One of Nashville's Largest Venture Capital and Private Equity Firms

Edison Partners named on Nashville Business Journal’s 2026 list of the largest venture capital and private equity firms in Nashville

January 26, 2026

Edison Partners Named a 2026 TOP 50 Private Equity Firm in the Middle Market & TOP 50 PE Firm for Founders

Dual recognition highlights Edison Partners’ leadership in lower middle market buyouts and founder partnerships

August 20, 2025

KnowledgeLake and Edison Partners Announce $65M Growth Investment

Fresh capital and newly appointed CEO to accelerate expansion of AI-powered document processing and workflow automation platform

July 22, 2025

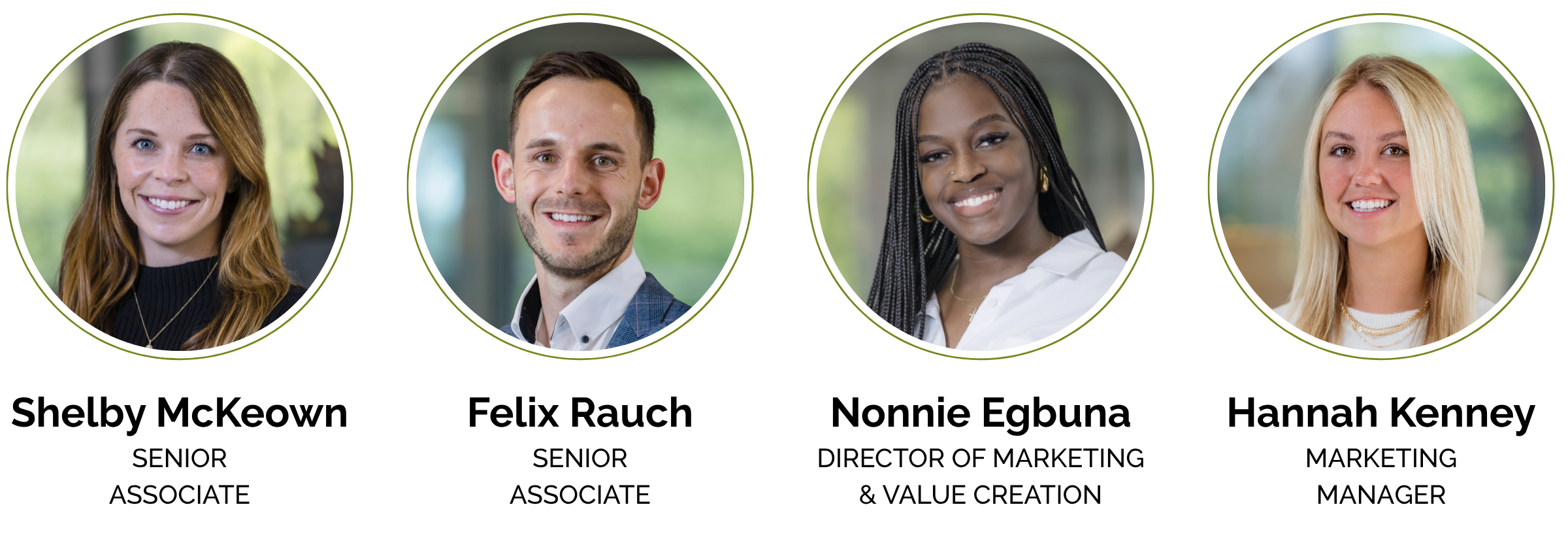

Edison Partners Announces Key Promotions Across Investment, Value Creation & Marketing Teams

New roles reflect the growth equity firm’s commitment to talent development and operational excellence

June 24, 2025

NPHub Secures $20M Growth Investment from Edison Partners to Expand the Country’s Nurse Practitioner Population

Edison Partners announces a $20M growth equity investment in NPHub, the leading platform for nurse practitioner training and hiring, to sup...

April 29, 2025

Edison Partners Announces Exit from MoneyLion Following Acquisition by Gen

Third Major Exit Since Start of 2025

February 25, 2025

Edison Partners Named A 2025 BluWave Top PE Innovator

Annual awards program recognizes growth equity firm amongst the top two percent of North America’s most innovative

February 24, 2025

Edison Partners Exits RapidDeploy To Motorola Solutions

Portfolio company exit reinforces firm's commitment to digitizing critical infrastructure across key public and private sector industries

January 24, 2025

Recycle Track Systems Secures Financing to Accelerate AI Innovation and Expand Sustainable Waste Solutions Across North America

Recycle Track Systems, Inc. (RTS) raises over $40 million to drive innovation and reshape the future of waste management.

December 10, 2024

Gen Extends its Financial Wellness Offerings with the Acquisition of MoneyLion

Gen Adds Financial Empowerment to Credit and Identity Protection Solutions

December 04, 2024

Zelis Adds Investors, Reflecting Strong Market Confidence in Mission

The company is well-positioned to modernize the healthcare financial experience.

October 29, 2024

Edison Partners 3x Inc. Founder Friendly Investor

Edison Partners recognized for the third time as an Inc. Founder Friendly Investor.

October 29, 2024

Edison Partners Leads $115M Growth Investment in Fingercheck

New capital infusion and appointment of highly experienced CEO to accelerate growth of end-to-end deskless workforce management platform.

September 26, 2024

Growth Equity Firm Edison Partners Doubles Down on K1x Investment

Edison Partners doubles down on leading SaaS company using AI to modernize K1 reporting.

August 27, 2024

Greater Nashville Venture Capital Association Announces Three New Board Members

Nashville, TN (August 27, 2024) – The Greater Nashville Venture Capital Association (GNVCA), a new industry association dedicated to foster...

July 11, 2024

AI-Driven Seismos and Edison Partners Team to Drive Energy Industry's Digital Future

New funding will accelerate company's expansion into additional markets.

June 05, 2024

Growth Equity Firm Edison Partners Promotes Michael Dirla to Vice President

Leading Investment Firm Expands its Bench of Talent by Developing and Promoting from Within

May 29, 2024

Solutions by Text Secures $110 Million Growth Round Led by Edison Partners and StepStone Group

Compliance leader on pace to double messaging volume this year, as highly regulated industries increase adoption of compliant text and text...

April 17, 2024

Growth Equity Firm Edison Partners Opens New Nashville Office

NASHVILLE, TN AND PRINCETON, NJ, April 17, 2024 - Growth equity investment firm Edison Partners announced today that it has opened a new of...

March 21, 2024

Edison Partners Welcomes Healthcare IT Executive Patrick O’Keefe as Operating Partner

PRINCETON, N.J. — MAR. 21, 2024 — Edison Partners, a leading growth equity investment firm, today announced the appointment of veteran heal...

January 10, 2024

120Water Secures $43M Growth Investment Led by Edison Partners

New funding boosts govtech-based ESG platform delivering measurable results.

October 31, 2023

Inc. Names Growth Equity Firm Edison Partners A Founder-Friendly Investor

Accolade Highlights Firm’s Ability to Accelerate Portfolio Companies’ Growth

September 19, 2023

Edison Partners Announces $25M Growth Investment in Take Command

Individual Coverage Health Reimbursement Arrangement (ICHRA) provider driving up to 20% cost savings for employers will scale growth with i...

August 09, 2023

Growth Equity Firm Edison Partners Hires Ben Laufer as Principal

PRINCETON, NJ — AUG. 9, 2023 — Edison Partners, a leading growth equity investment firm, is pleased to announce that Ben Laufer has joined ...

August 02, 2023

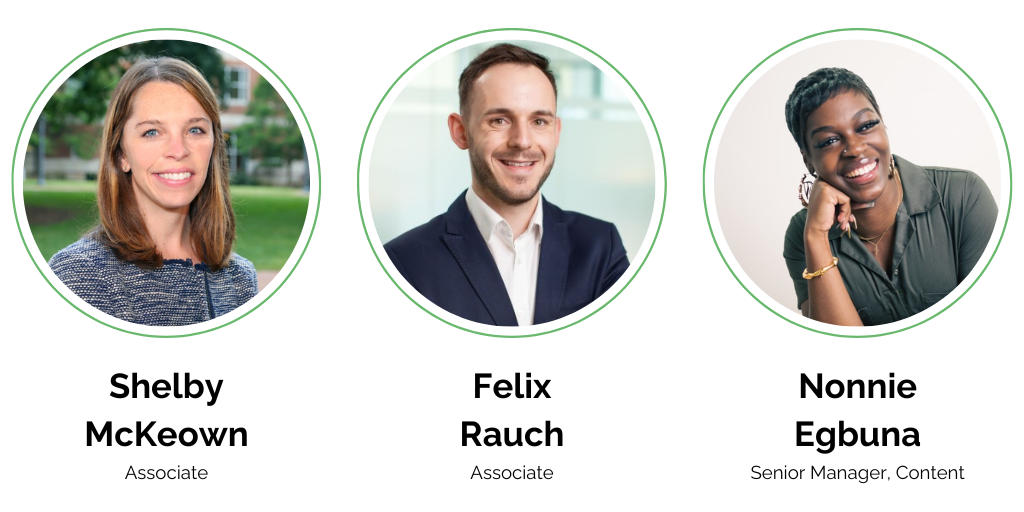

Growth Equity Firm Edison Partners Adds Three New Hires to Investment and Value Creation Teams, Continues Expansion

PRINCETON, NJ — AUG. 2, 2023 — Edison Partners, a leading growth equity investment firm, today announced the addition of three new hires, s...

July 11, 2023

Edison Partners Exits Digital Customer Education Leader Northpass to Gainsight

Edison Partners, the growth equity investment firm, today announced the sale of portfolio company Northpass to Gainsight, the world’s leadi...

April 21, 2023

Security pros should focus on IAM and insider risks following recent Pentagon leak

The recent leak of sensitive classified NATO-Ukraine war documents by 21-year-old Air National Guardsman Jack Teixeira to his peers in an o...

April 14, 2023

Edison Partners Named to GrowthCap’s List of Best Growth Investment Firms for a Second Consecutive Year

Edison Partners was named to GrowthCap’s list of the Best Growth Investment Firms for 2023.

April 03, 2023

Acorns Acquires GoHenry; Delivering Financial Wellness for Life’s Many Stages

Mission led company now serves nearly 6M subscribers globally; adding four new countries, and education products for kids and teens.

March 07, 2023

Overhaul Secures $73M in Growth Financing, Expands its Foothold in Global Supply Chain Visibility, Risk and Compliance Market

Funding enhances Overhaul's platform spanning visibility, risk, compliance, and insurance solutions to help safeguard cargo and improve eff...

February 06, 2023

Edison Partners Continues to Invest in Its Future With Three Promotions and the Appointment of John Shearburn as Senior Advisor

Edison Partners, a leading growth equity investment firm, continues to invest in its future with the promotion of three members of the firm...

January 25, 2023

RapidDeploy Raises $34 Million in Growth Funding, Led by Edison Partners

RapidDeploy to innovate and continue building its international reputation as a partner dedicated to putting state and local communities fi...

January 18, 2023

MacroFab Secures $42M in Growth Financing from Foundry, Edison Partners and BMW i Ventures

MacroFab, the cloud manufacturing platform for building electronics from prototype to high-scale production, with a network of more than 10...

December 15, 2022

Edison Partners invests $15 million in Schedule K-1 automation disruptor K1x, Inc.

Edison Partners announced a $15 million investment in K1x, the leading provider of automated solutions for aggregation and packet productio...

December 07, 2022

Edison Partners leads $21 million growth funding round for clinical trial intelligence disruptor Lokavant

Edison Partners, a leading growth equity investment firm, today announced it is leading a $21 million investment round in Lokavant, the le...

November 30, 2022

SPHERE Receives $31 Million in Funding, with Edison Partners as Lead Investor

SPHERE Technology Solutions (SPHERE), a leader in identity hygiene, announced today a $31 million Series B investment led by Edison Partner...

November 02, 2022

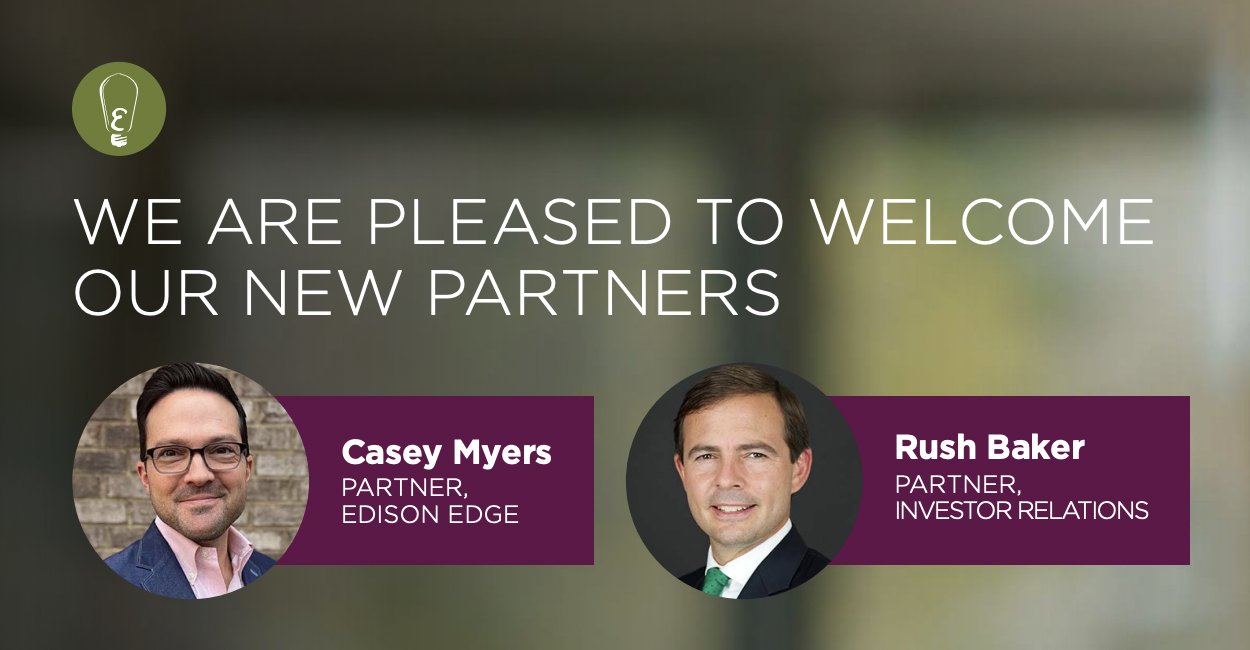

Edison Partners Adds to Senior Leadership, Continues Consistent Growth

Edison Partners, a leading growth equity investment firm, today announced the appointment of Rush Baker as partner, head of investor relati...

October 12, 2022

GoHenry Group raises $55M in Growth Capital

GoHenry Group raises $55M in growth capital to accelerate global expansion and boost financial education for young people GoHenry, the pre...

October 04, 2022

Edison Partners Leads USD $30M Investment in Field Effect

Edison Partners, a leading growth equity investment firm, today announced a USD $20 million investment in Field Effect, an Ottawa-based glo...

September 20, 2022

Edison Partners appoints Kelly Ford as its first Chief Operating Officer

Edison Partners, a leading growth equity firm, announced today the promotion of its general partner, Kelly Ford, to chief operating officer...

July 21, 2022

15Five Raises $52 Million Series C

Fundraise accelerates 15Five’s vision and solution, providing HR leaders with tools to make better strategic decisions and improve performa...

July 13, 2022

Edison Partners Promotes Robert Dickey to Principal

Edison Partners has promoted Robert “Bobby” Dickey to principal. This promotion recognizes Dickey’s contributions as a key member of Edison...

July 12, 2022

Prepaid Technologies Acquires Workstride, Advancing its Category-Leading Payments Platform

Prepaid Technologies, a pioneer in the rapidly growing digital payments solutions market, today announced the acquisition of WorkStride, a ...

July 11, 2022

Edison Partners Successfully Exits Energy Industry Disruptor Budderfly

Edison Partners, a leading growth equity firm, announced today that it will exit portfolio company Budderfly, in which Partners Group (SIX:...

April 04, 2022

Edison Partners Closes Tenth Fund

Largest fund in firm’s history surpasses target and hard cap

March 29, 2022

Online Furniture Marketplace Kaiyo Raises $36 Million In Series B To Accelerate Expansion, Led by Edison Partners

Kaiyo, a full-service marketplace for gently-used furniture committed to great design, exceptional customer care, and a more sustainable pl...

March 16, 2022

Spiffy Raises $32M in Extended Series B Funding with New Investment by Edison Partners

Get Spiffy, Inc. (SpiffyⓇ), an on-demand car care, technology, and services company, today announced it has raised $10 million from Edison ...

November 30, 2021

Solutions by Text Secures $35M Growth Investment Led by Edison Partners

Solutions by Text, provider of the text messaging platform for consumer financial services institutions, today announced raising $35 millio...

November 02, 2021

Prepaid Technologies Secures $96 Million Growth Round Led by Edison Partners

Prepaid Technologies, a Birmingham, Ala.-based provider of prepaid digital payment solutions, today announced raising $96 million in new gr...

October 20, 2021

Edison Partners Promotes Gregg Michaelson to General Partner, Jennifer Lee to Partner, and Joseph Giquinto to Chief Financial Officer

Edison Partners, the growth equity investment firm, today announced a series of executive appointments.

February 18, 2026

Payra and Edison Partners Announce $15M Growth Investment to Modernize Accounts Receivable for America’s Heartland Businesses

New capital to accelerate ERP-native payments and Cash Application automation for construction, industrial, and blue-collar suppliers opera...

February 11, 2026

Edison Partners Named One of Nashville's Largest Venture Capital and Private Equity Firms

Edison Partners named on Nashville Business Journal’s 2026 list of the largest venture capital and private equity firms in Nashville

January 26, 2026

Edison Partners Named a 2026 TOP 50 Private Equity Firm in the Middle Market & TOP 50 PE Firm for Founders

Dual recognition highlights Edison Partners’ leadership in lower middle market buyouts and founder partnerships

August 20, 2025

KnowledgeLake and Edison Partners Announce $65M Growth Investment

Fresh capital and newly appointed CEO to accelerate expansion of AI-powered document processing and workflow automation platform

July 22, 2025

Edison Partners Announces Key Promotions Across Investment, Value Creation & Marketing Teams

New roles reflect the growth equity firm’s commitment to talent development and operational excellence

June 24, 2025

NPHub Secures $20M Growth Investment from Edison Partners to Expand the Country’s Nurse Practitioner Population

Edison Partners announces a $20M growth equity investment in NPHub, the leading platform for nurse practitioner training and hiring, to sup...

April 29, 2025

Edison Partners Announces Exit from MoneyLion Following Acquisition by Gen

Third Major Exit Since Start of 2025

February 25, 2025

Edison Partners Named A 2025 BluWave Top PE Innovator

Annual awards program recognizes growth equity firm amongst the top two percent of North America’s most innovative

February 24, 2025

Edison Partners Exits RapidDeploy To Motorola Solutions

Portfolio company exit reinforces firm's commitment to digitizing critical infrastructure across key public and private sector industries

January 24, 2025

Recycle Track Systems Secures Financing to Accelerate AI Innovation and Expand Sustainable Waste Solutions Across North America

Recycle Track Systems, Inc. (RTS) raises over $40 million to drive innovation and reshape the future of waste management.

.png)

December 10, 2024

Gen Extends its Financial Wellness Offerings with the Acquisition of MoneyLion

Gen Adds Financial Empowerment to Credit and Identity Protection Solutions

-1.png)

December 04, 2024

Zelis Adds Investors, Reflecting Strong Market Confidence in Mission

The company is well-positioned to modernize the healthcare financial experience.

October 29, 2024

Edison Partners 3x Inc. Founder Friendly Investor

Edison Partners recognized for the third time as an Inc. Founder Friendly Investor.

October 29, 2024

Edison Partners Leads $115M Growth Investment in Fingercheck

New capital infusion and appointment of highly experienced CEO to accelerate growth of end-to-end deskless workforce management platform.

-1.png)

September 26, 2024

Growth Equity Firm Edison Partners Doubles Down on K1x Investment

Edison Partners doubles down on leading SaaS company using AI to modernize K1 reporting.

.png)

August 27, 2024

Greater Nashville Venture Capital Association Announces Three New Board Members

Nashville, TN (August 27, 2024) – The Greater Nashville Venture Capital Association (GNVCA), a new industry association dedicated to foster...

.png)

July 11, 2024

AI-Driven Seismos and Edison Partners Team to Drive Energy Industry's Digital Future

New funding will accelerate company's expansion into additional markets.

.png)

June 05, 2024

Growth Equity Firm Edison Partners Promotes Michael Dirla to Vice President

Leading Investment Firm Expands its Bench of Talent by Developing and Promoting from Within

-1.png)

.png)

.png)

.png)

.png)

-1.png)

.png)

.png)