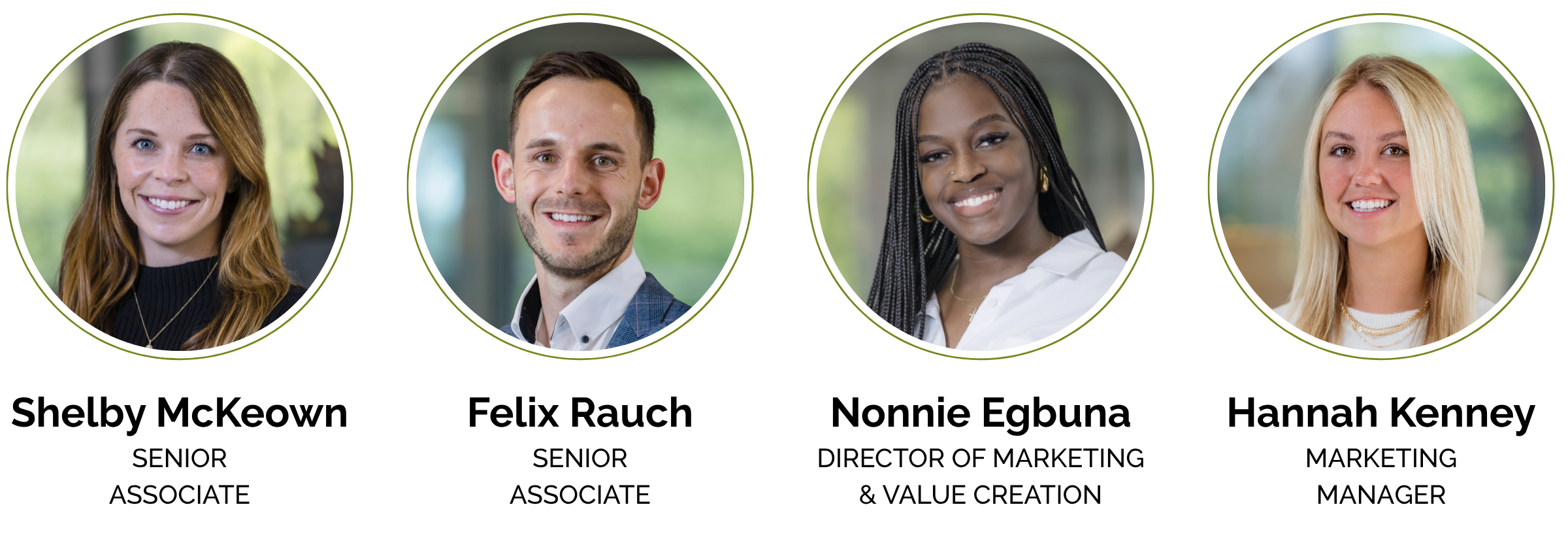

NASHVILLE, Tenn.--(BUSINESS WIRE)--Edison Partners, a leading growth equity firm, today announced the promotion of four team members across its investment, value creation and marketing functions: Shelby McKeown, Felix Rauch, Nonnie Egbuna and Hannah Kenney. Since joining the firm in 2023, each has made high-impact contributions to Edison’s growth.

“Edison’s strength has always been its people,” said Chris Sugden, Managing Partner. “These promotions reflect our continued commitment to developing the firm’s next generation of high-performing leaders."

“Edison’s strength has always been its people,” said Chris Sugden, Managing Partner. “These promotions reflect our continued commitment to developing the firm’s next generation of high-performing leaders across multiple functions. Each of these individuals has demonstrated talent, drive and impact that defines our culture. As they step into these new roles, we’re investing in both the future of our investment team and Edison Edge value creation platform to provide even greater support to our portfolio companies.”

Shelby McKeown - Promoted to Senior Associate

Shelby is instrumental in originating and executing investments across Edison’s target sectors in Financial Technology and vertical SaaS. Supporting all phases of the investment process, she contributes to initial analysis, due diligence and transaction execution. As part of her active portfolio, she works with high-growth companies like NPHub. Her background spans commercial credit and strategic corporate development roles at Bank of America, Lowe’s and Simplex Venture, an early stage fintech-focused venture firm.

Felix Rauch - Promoted to Senior Associate

Felix plays a key role in sourcing, evaluating, and executing investments in Healthcare IT and vertical SaaS. He is actively involved across all stages of the investment lifecycle, from deal diligence to deal execution and portfolio company support. Several of the portfolio companies he works with, including Fingercheck, 120Water and Seismos, focus on digitizing analog industries. He brings a strong foundation in analytical and operational insights to Edison’s investment team, with prior experience at Bailey & Company, a middle-market investment bank, Frist Cressey Venture, a healthcare-focused venture capital firm, and Deloitte.

Nonnie Egbuna - Promoted to Director of Marketing & Value Creation

Nonnie leads content strategy, development and operations for Edison Edge, the firm’s robust value creation platform that supports portfolio company growth. She also oversees firm-wide marketing, driving engagement across digital and brand channels. Nonnie draws on experience from marketing roles at startups like Vendition, Inclusivv and Zogo Finance to grow Edison’s brand voice and value creation resources.

Hannah Kenney - Promoted to Marketing Manager

Hannah supports the firm’s integrated marketing efforts across digital content, event programming and podcast development. A former entrepreneur who started and grew an event planning business, she brings expertise in communications and social media strategy and helps to drive Edison’s brand and thought leadership initiatives.

These promotions come as Edison Partners continues to expand its investments in high-growth, capital efficient, scalable companies across the Financial Technology, Healthcare IT and Enterprise Software sectors. In their newly elevated roles, these team members will be more deeply invested in supporting and driving Edison’s differentiated investment approach that combines a growth partner mindset, strategic capital and deep operational expertise through Edison Edge.

The Edison Edge is backed by a team of Operating Partners — C-level operators and subject matter experts who work with portfolio company leaders throughout the full investment lifecycle to drive solid, long-term growth in areas such as executive leadership and financial and go-to-market strategies.

About Edison Partners

Edison Partners is a leading growth equity firm providing the financial and intellectual capital that CEOs and their executive teams need to grow and scale their companies. The firm’s team brings more than 275 years of combined investing, operating and sector experience to each investment, accessible via the Edison Edge value creation platform, which is tailored to each business’ strategy, stage and operating needs. Edison targets high-growth vertical SaaS, financial technology and healthcare IT located outside Silicon Valley with $10 million to $40 million in revenue. Investments also include buyouts, recapitalizations, spinouts, and secondary stock purchases. Named as a Top Growth Investment Firm by GrowthCap for two years running, Edison’s active portfolio has created aggregated market value exceeding $10 billion. Edison Partners manages over $2.2 billion in assets. For more information on Edison Partners, please visit edisonpartners.com and follow on LinkedIn.