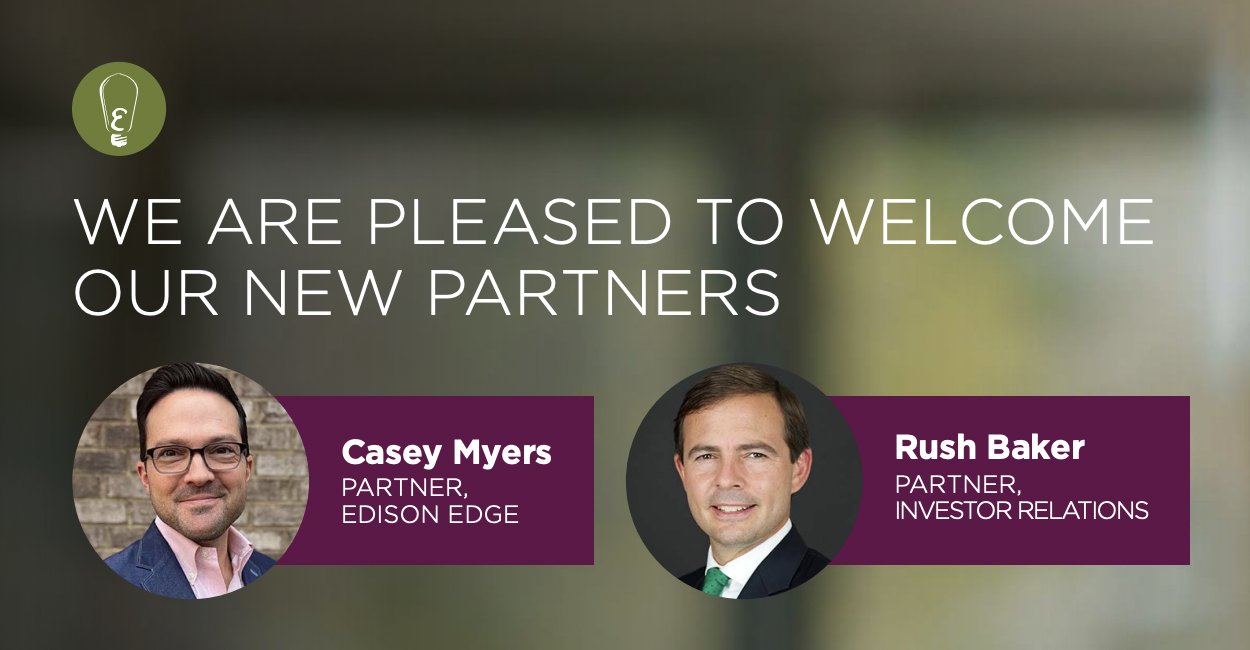

Edison Partners, a leading growth equity investment firm, today announced the appointment of Rush Baker as partner, head of investor relations, and Casey Myers as partner, head of Edison Edge value creation platform. In these newly created roles, Baker and Myers will further expand the breadth and depth of the Edison senior team’s capabilities as the firm’s AUM increases.

“We’re focused on building ‘a forever firm,’ so it’s essential that we continue to add expertise to help us scale not only our AUM, but also how we partner with our portfolio companies in bringing more than capital to each investment. We are very pleased to welcome Rush and Casey to lead these two critical aspects of our business,” said Chris Sugden, managing partner, Edison Partners.

Global private market fundraising expert Rush Baker to lead investor relations

Baker will lead communications with existing and prospective limited partners. In sourcing new capital partners for the firm, he will leverage the firm’s strong foundation of superior performance, and bring it to new markets. “It's exciting to join Edison at this inflection point of growth and opportunity, and to build on a deep track record of success as a growth equity leader. The team is stellar, as is their differentiated approach to partnering with investors and portfolio company executives. I look forward to helping expand Edison’s already great cadre of capital partners,” said Baker.

Before joining Edison, Baker was a partner at Snowbridge Advisors, a New York-based private fund placement platform specializing in private equity and debt fund advisory and capitalization. He began his career in finance at Deutsche Bank where he developed relationships with some of the largest institutional investors in the U.S., Asia and Europe.

Seasoned growth-stage operator Casey Myers to lead the Edison Edge platform

Myers will direct the Edison Edge, the firm’s value creation platform, which includes five operating centers of excellence, executive education programs, and a director network – all designed to help portfolio companies navigate, accelerate and scale growth. Myers will build community and peer connections among portfolio management teams, and continue to expand best-practice expertise and content aligned with portfolio business models, lifecycle stages and individual company needs.

“Having seen growth equity from the operator point of view for over two decades, I understand the tremendous value of the partnership, mentorship, education and peer activation that Edison Edge provides. It’s also exciting to be a part of a culture of ‘fierce stewardship’ – of time, money and resources – and a team dedicated to leveraging those assets with passion, excellence and integrity. I look forward to harnessing this as we continue to expand the ways we help our management teams build market leadership,” said Myers.

A dynamic leader, Myers brings more than 20 years of operating experience in executive management, business strategy, go-to-market and corporate development across industry sectors and stages in which Edison Partners invests. Most recently, during his tenure at SundaySky, he held several go-to-market leadership positions and led a multi-faceted sell-side process, resulting in a successful $100+ million private equity transaction. Earlier in his career, Myers helped Exstream Software grow revenues by five times in four years, and successfully exit to Hewlett Packard.

These two appointments are a continuation of Edison’s momentum in 2022, which includes the close of the Edison X fund; active investing in underserved geographies, such as Texas, Alabama, North Carolina and Ottawa, Canada; the addition of five operating partners to support portfolio company growth and execution; and General Partner Kelly Ford’s recent promotion to chief operating officer.