If you’ve been following along with this year’s Growth Index, then you’ve heard our rally cry: “growth at all costs” is over, and durability is the new North Star for growth-stage companies. In an era where capital is more expensive than ever, investors are looking for companies that can balance sustainable growth with strong profit margins. One leading indicator of a truly durable company is go to market (GTM) efficiency.

GTM Efficiency as a Durable Growth Lever

“Go to market efficiency” measures how well a company’s sales and marketing investments translate into predictable, profitable revenue. It reflects the way GTM teams both get and grow customers relative to spend — taking into account metrics like customer acquisition costs (CAC) payback, AE productivity, and revenue per dollar of GTM spend. High GTM efficiency signals a mature, scalable growth engine that drives both top-line momentum and bottom-line accountability, ultimately contributing to durable growth.

Let’s take a look at how GTM efficiency showed up in this year’s Growth Index analysis:

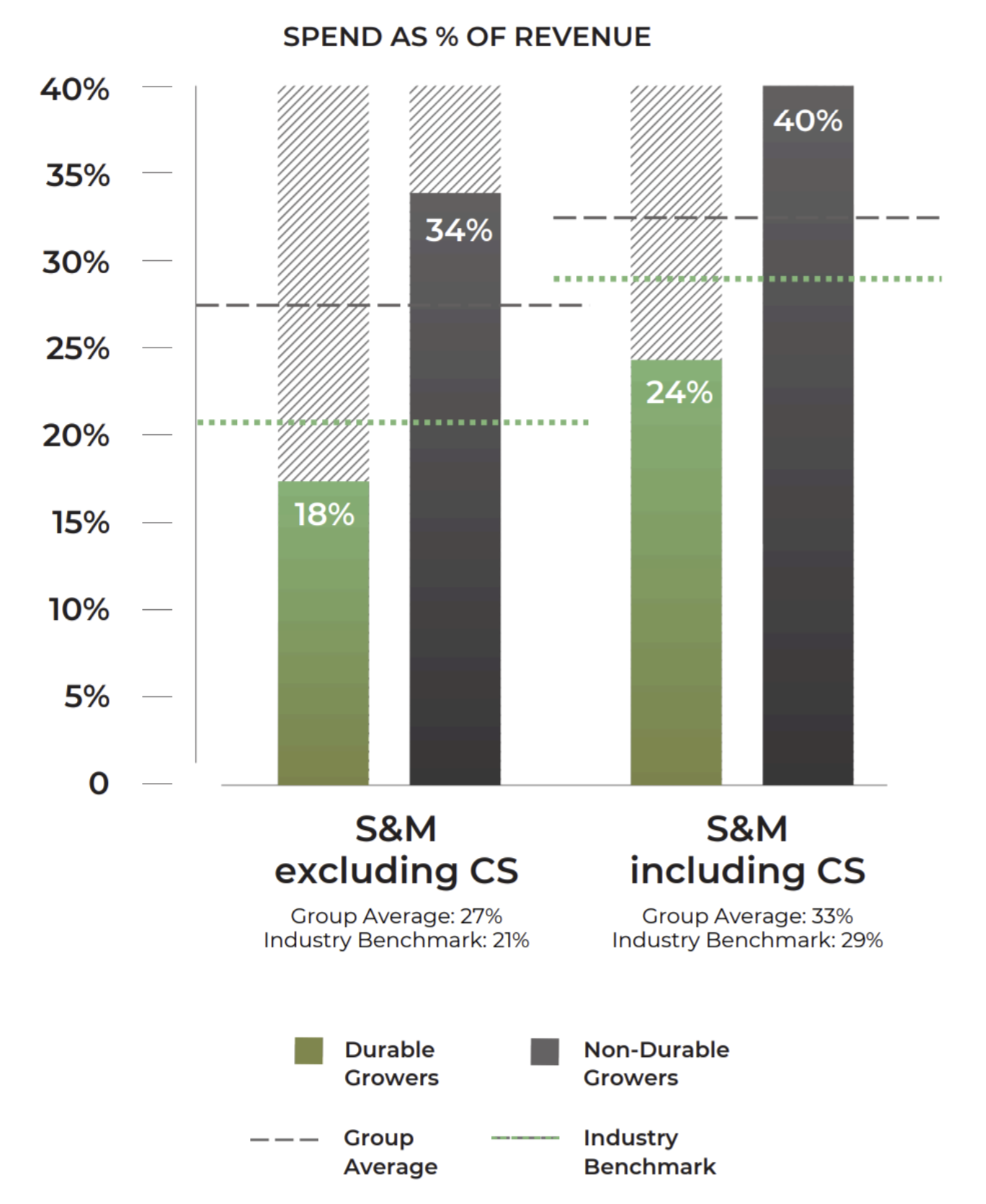

Sales & Marketing Spend

In our analysis of durable versus non-durable growers, sales & marketing (“S&M”) expense showed the highest differential of impact. With or without inclusion of Customer Success, durable growers were significantly more efficient in S&M expense as a percentage of revenue. When compared to other operating expenses (which we’ll cover more in a later blog), S&M stood out as having the biggest differential between the durable and non-durable cohorts: a 16-point delta, equating to a roughly 50% more efficient spend for durable growers.

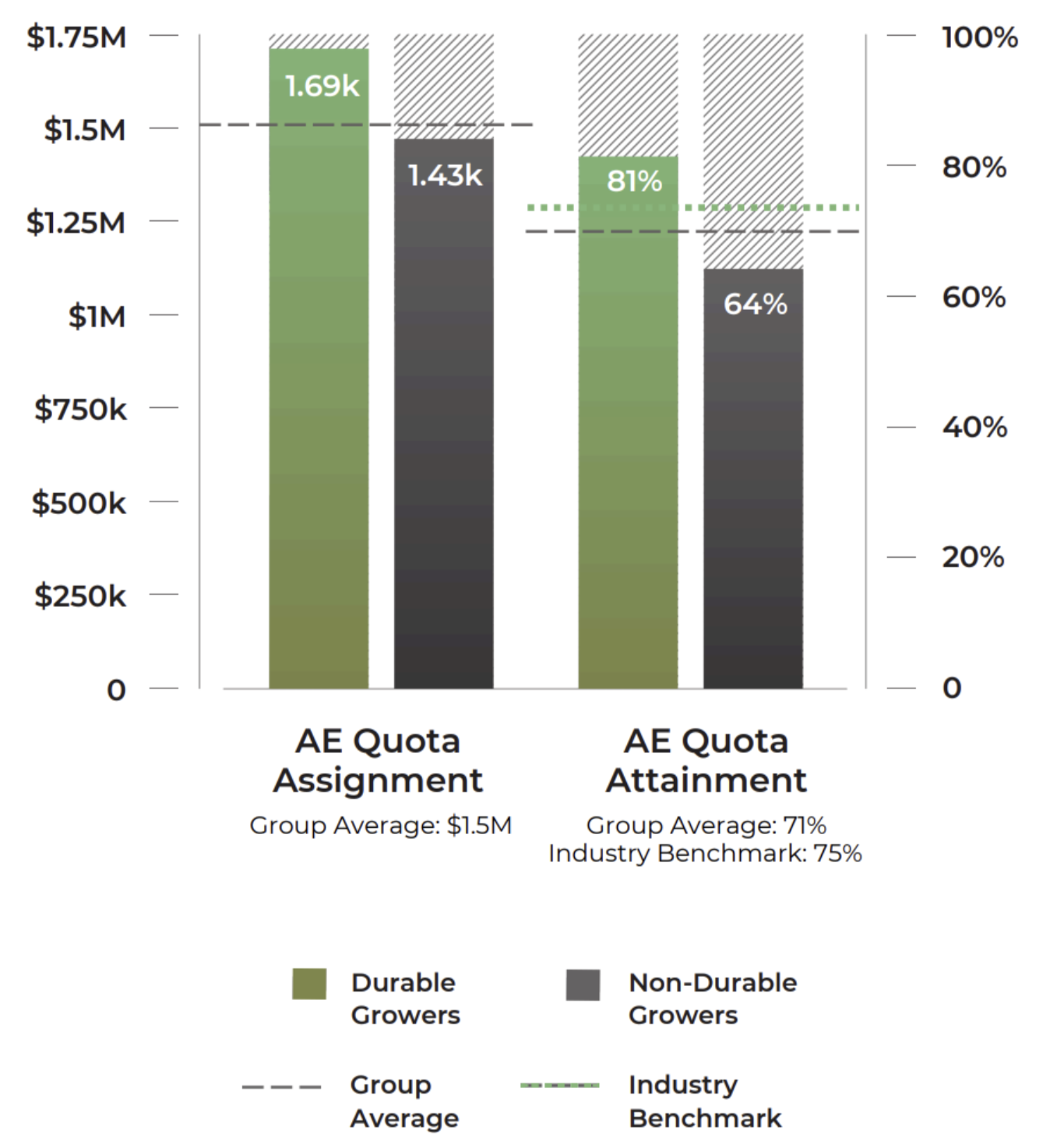

AE Productivity

While durable growers have mastered the art of retention (see below), they are also extremely effective at acquiring new revenue.

Participants’ average quota assignment (normalizing for certain model discrepancies in our dataset) was just over $1.5M, with durable growers averaging 18% higher quotas when compared to the non-durable cohort. Regarding AE performance, durable growers’ AE quota attainment was 26% higher than the non-durable average.

Greater AE productivity for durable growers also translated to more favorable customer acquisition costs (CAC) timelines. Participants’ average CAC payback period was 19 months, with durable growers averaging 30% better (15-month average compared to 21-month average).

Retention

In our last blog, my colleague Mariann McDonagh wrote about retention as the engine of durability. As mentioned in that blog, durable growers saw 89% average GRR (compared to 75% for non-durable growers) and 109% NRR (compared to 89% for non-durable growers).

This “keep, grow, then get” mindset undoubtedly contributes to the GTM efficiency evident in durable growers.

How Companies Can Drive GTM Efficiency

Go to market efficiency begins with go to market maturity. Even in past years’ Growth Index report, which focused more on fast growers than on durable growers, GTM maturity proved to be a key value creation lever. As we point out in this year’s Index:

Our historical and current data confirms that mature GTM organizations outperform by driving predictable revenue, efficient customer acquisition, and intentional expansion. Fast growers consistently show tight forecast accuracy, high-performing account executives (“AEs”), and a diversified sourcing of new logos (most often from marketing and partners, not just sales). The most successful companies avoid single-threaded tactics, pre-emptively tie GTM spend to revenue impact, and continuously refine ICP to reflect buyer persona realities.

In addition to these disciplines, here are a few other operating practices companies can put in place:

-

Foster cross-functional alignment: GTM efficiency is attained when sales, marketing, and customer success teams share goals, metrics, and a unified view of the customer journey. Seamless handoffs and shared accountability improve outcomes at every stage of the funnel.

-

Incentivize durable behaviors: Consider implementing AE compensation plans that balance growth and efficiency — rewarding reps not just for bookings, but also for retention, CAC payback, or multi-year deals. Support reps with structured onboarding and consistent pipeline coverage.

-

Promote lean, productive teams: Durable growers reduced their headcount by 14% YoY while achieving 2x revenue per FTE compared to non-durables. They resist bloated org charts and focus instead on high-impact roles and highly-enabled reps.

-

Prioritize customer success: High-performing and durable teams treat customer success as a revenue driver, not a cost center. Durable companies achieve NRR above 100% by investing early in expansion programs and renewal playbooks. (Remember, though: GRR is the foundation, and NRR is the multiplier.)

-

Audit GTM spend: Map every dollar of GTM spend to measurable outcomes. Eliminate activities that don’t tie directly to pipeline creation, conversion, or expansion.

-

Shorten CAC payback windows: Monitor CAC payback and aim for sub-18-month cycles. Shift spend toward the most efficient acquisition channels and reduce sales cycle time.

-

Revisit ICP regularly: GTM efficiency improves when teams are targeting the right customers. Update ICP definitions based on actual usage, retention, and expansion data — not just aspirational personas.

GTM efficiency is a core differentiator of durable businesses, and it is key to success in a capital-constrained market.

For further insights on GTM efficiency and the durable growth imperative, download the 2025 Growth Index.