Whereas speed was once thought to be the most critical aspect of growth, today, it is all about staying power. In fact, we like to think of retention as the engine of durable growth, as companies that succeed at keeping and growing their existing customers tend to scale more efficiently and be better positioned for sustained success.

Retention as Durability

The 2025 Growth Index deviates from prior years’ reports in that it focuses on durable growth as opposed to fast growth. While this change produced many new insights, a few commonalities emerged between fast and durable growers, one of which being that both maintain a "keep, grow, then get” mindset.

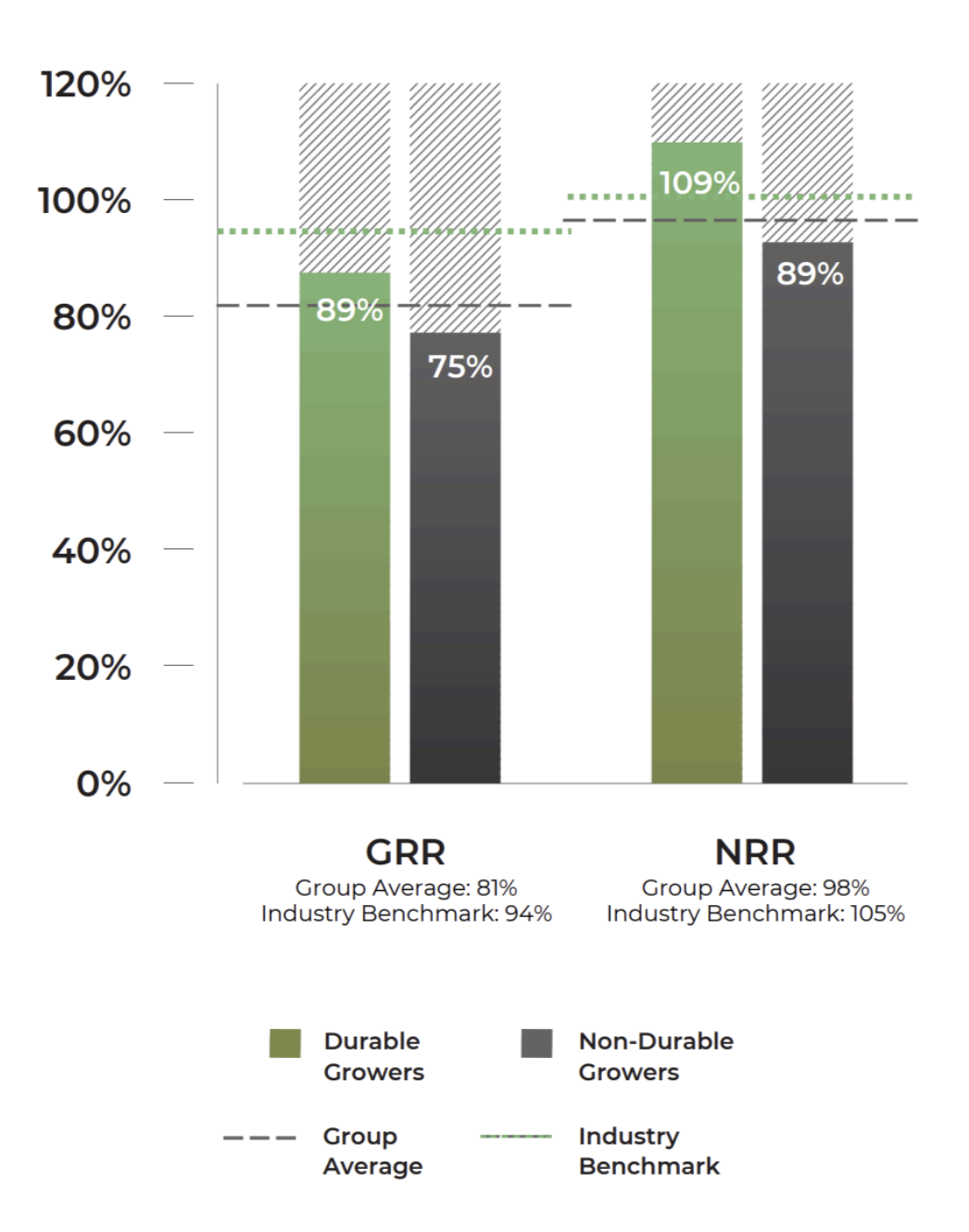

Retaining and growing customers (gross and net revenue retention, or “GRR” and “NRR”) is the clearest indicator of product-market fit and long-term enterprise value. Durable growers averaged 18% higher GRR and 22% better NRR when compared to the non-durable cohort. This strong retention means that there is less pressure on acquisition and thus more efficient revenue growth.

This raises an important consideration for companies looking to improve their retention metrics: think of GRR as the foundation, and NRR as the multiplier. If your GRR is healthy, your NRR is scalable; if GRR is weak, fix that first, or you’re building on a shaky foundation. Prioritizing keeping and growing over “getting” new customers is a hallmark of successful growth-stage companies.

The Role of Ideal Customer Profile and Product-Market Fit

Durable companies focus on one product that solves a clear problem for a well-defined ICP. As Product & Technology Operating Partner, Greg Nicastro, puts it:

“...Durable growers have well-established product/market fit, have picked the right ICP, and are executing against it with a single product offering. As a result, Engineering is more efficient and can dedicate existing resources to product enhancements that positively impact customer retention and add momentum for expansion.”

Nicastro’s insights align with data derived from our Growth Index survey, which showed that durable growers’ average product & engineering (P&E) spend was 40% better than the non-durable cohort. These differences suggest that durable growers have more mature products, allowing them to spend fewer resources on new product development.

This product alignment translates to more efficient sales & marketing (S&M) spend, with durable growers seeing 2.7x revenue return per S&M dollar (more on this in a later blog).

All of this to say, if your ICP is muddy or you haven’t yet proven that your product sufficiently addresses customer pain points, your path to customer retention (and, subsequently, durability) may not be immediately clear. As one portfolio CEO put it, durability starts with a targeted, repeatable customer journey, at which you can’t arrive without a solid ICP and strong product-market fit.

Retention is a Team Sport

As the previous section implies, driving customer retention requires a concerted effort across multiple functions: product, marketing, sales, and customer success.

Some might argue that everything starts top-of-funnel with marketing; however, it’s the full journey that ultimately drives stickiness. With a highly targeted product and a repeatable customer journey, teams can optimize every touchpoint in order to keep and grow more customers.

The metrics addressed above — NRR and GRR — as well as other useful customer insights like net promoter scores (NPS), can help you shape product and go to market priorities and allocate resources accordingly, ultimately driving more durable growth.

In the game of durable growth, retention is everything.

If you want to grow wisely and profitably, invest in the engine that keeps customers around.

For more insights around durable growth, download the 2025 Growth Index.

.png)