As the CEO of a PE-backed growth stage company, you're likely exploring multiple paths for your next chapter – whether that's positioning for a strategic acquisition, preparing for an IPO, or transitioning to a larger PE firm. While financial metrics and market positioning drive valuation discussions, seasoned PE investors know that people and organizational readiness can significantly impact both deal success and multiple expansion.

According to a 2022 Teneo article, despite “overwhelmingly positive sentiment towards the value of leadership, the evidence from our research shows a profound gap between the importance that PE firms attach to leadership and the time, resources and money they dedicate to optimizing it – a paradox for an industry that is performance-driven by definition.”

At Edison, we believe time spent on CEO and executive team performance and capability, starting at the diligence phase through exit, are time and monetary investments worth making, leading to stronger returns at the back end. PE firms must look at organizational health, leadership capabilities, and bench strength as critical factors in valuation for subsequent rounds or exit.

This blog focuses on preparing your organization for whatever path you choose.

Start With Leadership: Months 18 Through 12

Let's be honest: the strength of your leadership team can make or break your exit. It makes sense, then, that the most valuable action you can take as a CEO is to assess and strengthen your current leadership team (and leadership bench) well before starting exit discussions.

Depending on the type of transaction, you’ll need to assess your leadership team’s readiness for various scenarios. How prepared are they to work under new ownership and/or to navigate more complex stakeholder management? M&A deals call for scaling operations; are your current and future leaders equipped to work with teams two to three times their current size? Are these the people you’d trust to lead a post-transaction integration? Based on your assessment, consider adding or changing executive team leadership roles that appeal to future buyers:

- A COO who understands operational scalability

- A CRO who brings better revenue predictability

- A CPO who is better versed to drive a product strategy and roadmap priorities

- A CFO with a deep understanding of the transaction experience

Build Your Talent Infrastructure: Months 12 Through 6

Usually, strategic buyers are as interested in talent bench as they are in one’s market position. So, conducting a clear capability assessment and parallel succession plan for key roles will significantly de-risk the transaction. While this process should already be part of your talent management approach, now is the time to get serious.

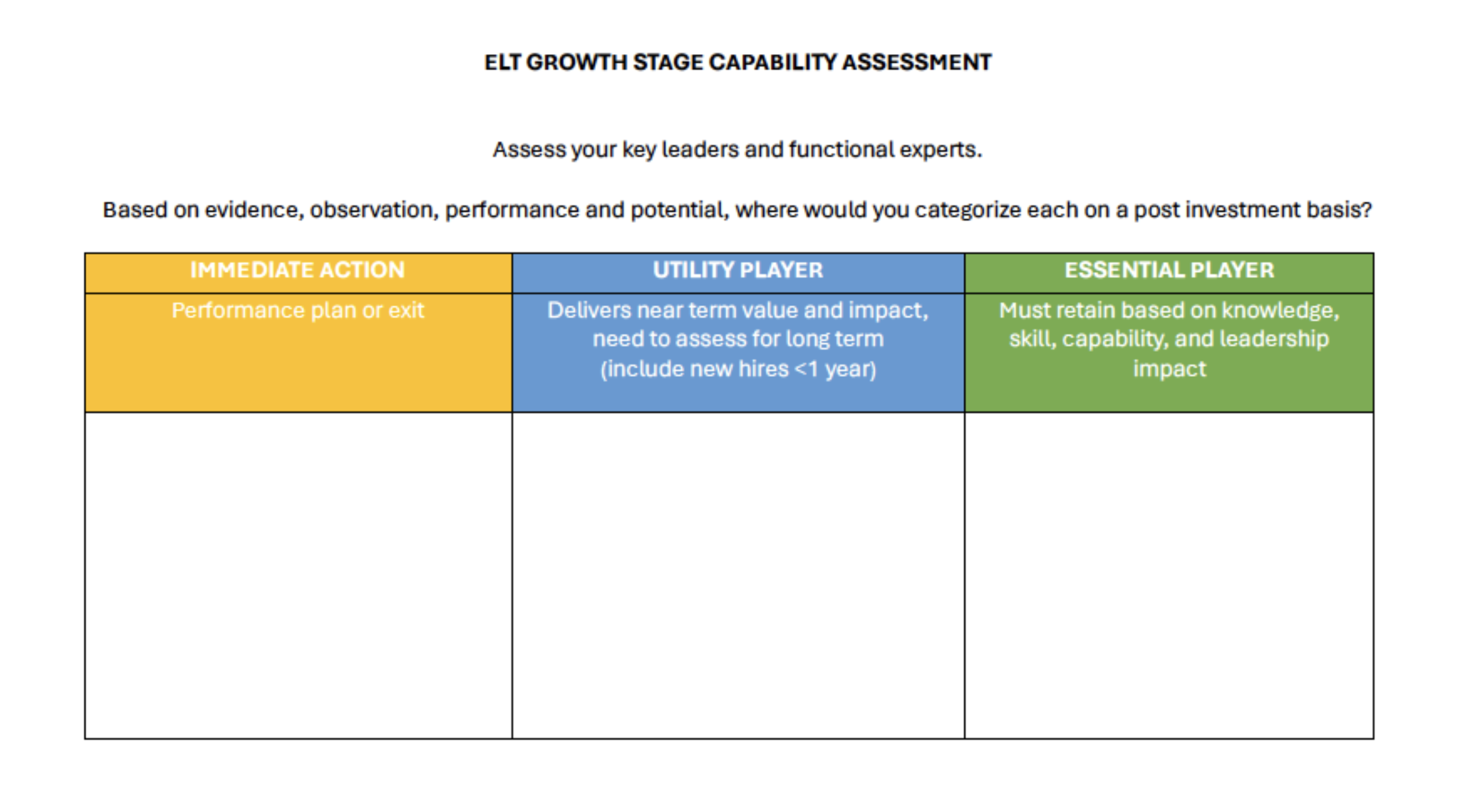

Putting yourself in the shoes of a strategic buyer, you might use this simple template to get started:

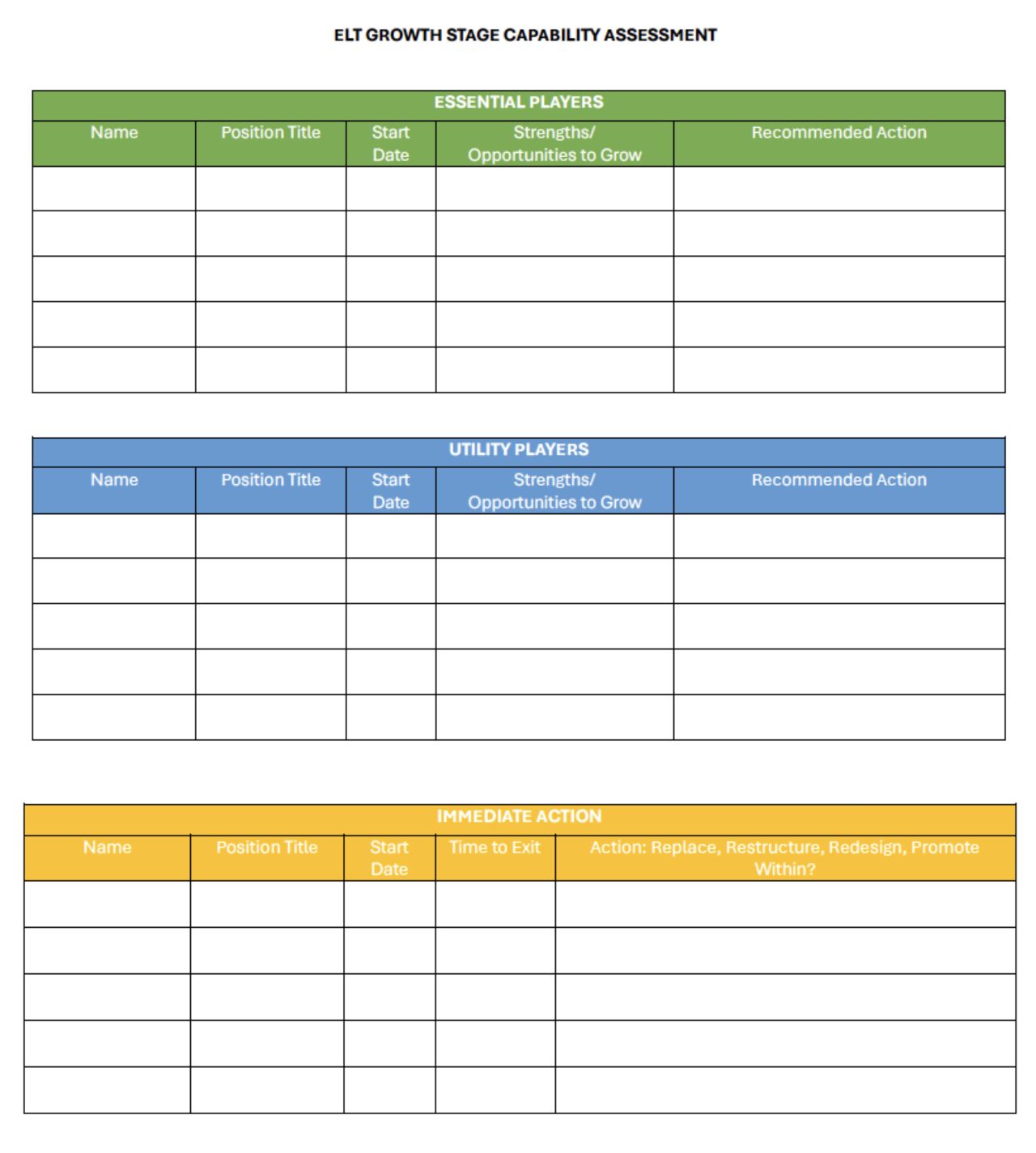

...and, per each category, add more actionable details:

Strengthen Your Culture: Months 6 Through Exit

It’s been my experience that culture becomes a tangible asset when you can demonstrate how it drives performance. Thus, creating clear linkages between your cultural practices and operational excellence is essential. Focus on metrics that matter to potential new investors or strategic buyers:

- Leadership change readiness and scalability assessments

- Key role retention risk or needed actions

- Succession readiness

- Cultural alignment as the business has navigated change

- Employee engagement over time

Your exit preparation needs to support multiple potential paths. Whether you're positioning for a strategic sale, preparing for an IPO, or planning to graduate to a larger PE firm, strong organizational readiness expands your options and enhances valuation multiples.

The People Questions That Matter

As you get your exit readiness process started, consider the following questions:

Leadership

Your leadership team is the engine driving the company forward. Buyers will look closely to see if your team is capable of sustaining and accelerating growth post-exit.

Strength and Alignment

-

- Is the leadership team aligned with the vision, timing, and strategic goals for an exit?

-

- Can every leader clearly articulate the company’s strategy, value drivers, and growth story?

Gaps and Succession

-

- Are there critical leadership gaps that need to be addressed before a sale?

-

- Have you developed robust succession plans for key roles to ensure continuity post-exit?

Credibility and Communication

-

- Does the team have the credibility and trust required to engage effectively with buyers, investors, or regulators?

-

- Are leaders prepared to handle the communication demands of the exit process?

Talent and Workforce

Your company talent—and how you manage it—reflects its scalability and resilience. Prospective buyers will dig deep into your ability to attract, retain, and develop top talent.

Depth and Retention

-

- Do you have the right talent in place to execute on your growth strategy and support the next stage under new ownership?

-

- Are there key employees at risk of leaving during the exit process, and do you have retention plans in place?

Performance and Development

-

- Are you optimizing team performance through clear goals, regular feedback, and development opportunities?

-

- Is there a structured approach to identifying and developing future leaders?

Employee Engagement

-

- How engaged and motivated is your workforce, and will they see the exit as an opportunity or a disruption?

-

- Are you communicating transparently with employees about how the exit might affect them?

Culture and Values

You might think of culture as a soft, intangible asset—but it can make or break a transition. A resilient, adaptable culture will reassure potential buyers that your company can navigate change.

Cultural Resilience

-

- Is your culture strong and adaptable enough to withstand the uncertainty of an exit?

-

- Are your values clearly defined and demonstrated by leadership?

Integration Readiness

-

- How would your culture align with that of a potential buyer or new ownership structure?

-

- Are there cultural strengths or weaknesses that would impact integration post-exit?

Cultural Risks

-

- Are there cultural elements (e.g., silos, lack of diversity, high turnover) that could be red flags to buyers?

-

- Are you leveraging culture as a competitive advantage to enhance valuation?

Legal and Compliance

Legal and compliance readiness is critical to ensuring a smooth exit process. Buyers will scrutinize your employment practices, policies, and risk management strategies, so early preparation here will ensure a much smoother process.

Documentation and Processes

-

- Are employment contracts, non-compete agreements, and equity compensation plans well-documented and enforceable?

-

- Is your employee handbook, code of conduct, and compliance training up-to-date and aligned with regulations?

Risk Management

-

- Are you compliant with all labor laws, workplace safety standards, and data privacy regulations?

-

- Have you identified and mitigated potential liabilities (e.g., unresolved disputes, pending lawsuits, or compliance gaps)?

Policies and Practices

-

- Do you have robust policies in place for harassment, discrimination, and whistleblowing?

-

- Are you prepared for buyer due diligence on issues such as diversity metrics, pay equity, and employee relations history?

Post-Exit Implications

-

- Have you considered how change-in-control provisions, severance agreements, or stock option vesting will impact the exit?

-

- Are there any legal risks associated with intellectual property ownership or employee IP agreements?

-

- Are all legal and compliance requirements documented and up to date?

-

- Have you conducted an internal audit to identify and address risks before buyer scrutiny?

Bringing It All Together

Finally, remember the exit process is stressful... for everyone. CEOs must ensure cohesion and clarity across their team and the company at large. Preparing for an exit isn’t just about numbers—it’s about building a company that’s poised to thrive through and beyond the transition. By focusing on these people areas, you’ll not only increase the likelihood of a successful exit but also maximize your company’s value and legacy.