How much GAAP revenue is your company going to record this year? What about last year? (Queue growth rate calculation…)

We’re all focused on topline growth. When we sit down to do our budgeting for the upcoming year, we generally set growth targets. Whether it’s bottoms-up, top down, or a number picked out of a hat, growth rate is generally the first thing on people’s minds. But as we think about our ability to influence our company’s growth, we generally only consider what we can do within the current accounting period. At our recent CFO Breakfast, we dove into the new revenue recognition standard, ASC 606, and the whole time I could not get a particular thought out of my head: do I always want to accelerate revenue recognition?

Needing to play devil’s advocate, my answer to my own question is “no.” Now, I need to clarify: GAAP revenue is an accounting metric, not an operating metric. I still subscribe to the ABCs of sales (Always Be Closing), but I’m talking about GAAP revenue here, not sales. I’m thinking about the situation where we have to decide whether to accelerate recognition of a single element within a contract or recognize all elements ratably over the life of the contract. This is a very common scenario for SaaS companies with upfront implementation services and can be a material driver of revenue.

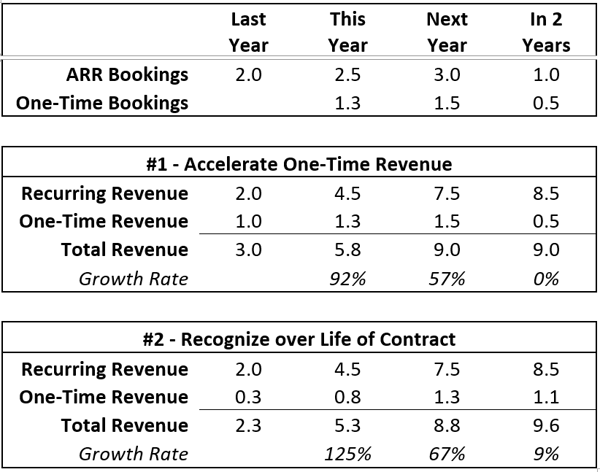

So, let’s go back to my initial two questions and put some actual numbers behind it.

Disclosure for Accounting sticklers: The above numbers assume all bookings are made on the first day of the year, all contracts have a term of three years and retention is 100%

Both #1 and #2 follow the same bookings pattern, the only difference is the revenue recognition methodology. In the first scenario, the company has higher GAAP revenue for the first three years, BUT a lower growth rate. In the second scenario, the company maintains a higher growth rate in all years AND has higher GAAP revenue in the final year. If the company is fundraising in that final year, I sure hope they followed methodology #2!

The above illustration also points out one of the beauties of a subscription-based, recurring revenue model. In the final two years, the company goes from a 4.5M bookings year to 1.5M. In a one-time sales model, that’s a 67% decline in revenue. If you only look at GAAP revenue, you’ll know growth has slowed, but would you have known that new bookings declined by 67%?

So as you think about revenue recognition, don’t just slam your foot on the pedal. Take a step back. Grab a glass of water. Call your accountant. Think about the impact to your growth rate over multiple years. Then write your revenue recognition policy memo!