Building a successful company isn’t just about growth – it’s about scale.

Growth means adding resources at the same rate that you’re adding revenue. For example, a company that gains a customer hires more people to service them and adds revenue at the same rate it is adding more cost. This is typical in many professional services-driven business models. While the company is technically growing, they’re not scaling.

Scale is about adding revenue at a rapid rate while adding resources at an incremental rate. Google, Salesforce.com, and Citirx are prime examples of successfully scaled businesses. They have mastered the formula of quickly adding customers while adding fewer additional resources; thus, driving consistent growth and increasing margin over time.

Scaling growth is about creating business models and designing your organization in a way that easily scales in order to generate consistent revenue growth and avoid stall points without adding a ton of extra cost and/or resources along the way. Here are five strategies for consideration as you think about scaling your early or growth-stage business.

Strategy # 1: Boost Renewals

Lifting renewal rates compounds your revenue base and topline growth. There’s a lot of torque in adding five, or even three points, to your renewal rate, then, of course, maintaining or, better, improving it over time.

Meanwhile, the opposite is true. Low renewals hold back revenue growth and scalability. An 85% renewal rate will consume at least 15% of your new business bookings growth in order to maintain revenue growth. Most companies can’t overcome weak renewal rates, while the best companies consistently achieve 95% renewal rates. SiriusDecisions looks at the problem from an operational perspective and offers some keys to improving customer renewal rates in this article. We also recommend checking out related data and advice available in our Growth Index.

Embracing a "land & expand" sales approach can also positively influence renewal rates. For example, you might aim to get half of your target growth rate from expansions by proving value in one area of your customer's business, then expanding to other areas. As your platform or solution becomes more far-reaching and stickier, the greater likelihood the customer will stick (renew) with you.

Strategy #2: Hire Good Product-Minded People

Too many companies don't hire product marketers and/or product strategists because the CEO has not worked with one before, or at least not a great one (Jason Lemkin of SaaStr recently wrote a great piece on this topic). This is extremely common in the AdTech space, as well as enterprise SaaS sectors.

Hiring strong product-minded people gets you the following:

- Customer-centricity

- Alignment of product development with market needs

- A focus on selling effectiveness

- A focus on delivery efficiency and effectiveness

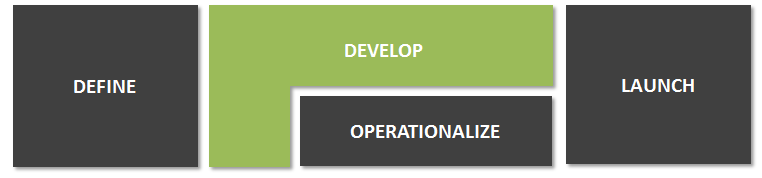

- An end-to-end (i.e., define, develop, operationalize, launch), cross-functional perspective on what it takes to successfully and scalably release product

- I could go on...

A simple example of an end-to-end product release process.

This is a strategic function, typically reporting to Marketing, or sometimes, to the CEO directly. It is not uncommon for product managers (vs. product marketers or strategists) to sit in the R&D organization, but in that case, you are less likely to achieve the above points, as the role then becomes more tactical, focused on gathering and prioritizing technical requirements.

Strategy #3: Package Value-Added Services for Repeatable Selling & Delivery

Whether you're scoping every professional services project (as if they are unique) based on man hours, selling one-size-fits-all services, or, worse, giving service hours away for free -- these practices are not scalable. Package your service offerings as if they are products, using project-based pricing or even annual/timeline subscriptions. Some examples:

1. Implementation. Inspect what it takes to deploy your solution to one customer profile vs. another, in terms of the required roles/service type (e.g., discovery, architect, integration, QA, project management) and hours per service type. Roll that up into product implementation packages priced at a digestible flat fee relative to the annual software cost. This enables your salespeople to sell off the price list, rather than chase down resources for scoping every single deal. This also drives alignment in the services organization, in terms of time-to-live (time-to-revenue recognition) expectations.

2. Reporting. Are your account managers delivering regular reports and/or responding to requests for custom reports from customers? How many hours per month is being spent on this? Could these reactive service requests be flipped to be a proactive value-add, for-fee reporting/analytics service? (Better yet, per Strategy #4 below, how can such reporting needs be better built into the product so that customers can self-serve?)

3. Ongoing Optimization. Few B2B SaaS solutions are "set it and forget." Offer an optimization package for a flat annual fee that ensures your solution is rolled out and actively used, continually aligned with your customers' business needs, and that they are getting the most from their deployments.

Strategy #4: Combine ownership of Product Management with Services Delivery

At our CEO Summit in June, we held a sausage-making roundtable entitled Get Some R&D Satisfaction. Edison's own Chris Clark led a discussion that resulted in a key takeaway for the group: combining Product Management with Product Delivery "keeps the roadmap in the money, the customer experience in the center of the roadmap, and a focus on delivering revenue.” This also lends itself to more scalable service offerings and a more scalable end product. Particularly in the early and growth stages of company development, if product managers can see firsthand how the product is being deployed, integrated, optimized, etc., then they are in a better position to productize capabilities that otherwise require customization work and service hours to activate.

Strategy #5: Fire the Sales & Marketing Engine on Multiple Cylinders

Multifaceted go-to-market models tend to offer the best growth and scale opportunities when executed effectively. This could mean:

- Selling to multiple verticals at the same time, e.g., retail, financial services, travel

- Selling to more than one market segment, i.e., enterprise, mid-market, small business

- Selling through more than one channel, e.g., direct, online, VARs

Whether you're firing on multiple cylinders within one of the bullets above or across them, at least three cylinders is the magic number. The best companies will attack this opportunity as early as possible in their journey while making the most of limited resources. For example, if it is premature (too costly) to dedicate sales territories and marketing managers on a per-industry basis, consider aligning sales and marketing resources with the industries that have business models in common, i.e., retail and travel industry business models are transactional in nature, while financial services and telecommunications are recurring. Also, if you are expanding from enterprise into the mid-market, you may very well be in a position to simply expand the number of target buyers, leveraging existing lead generation tactics and resources.

Of course, there are many ways to skin the scaling cat. What are your strategies and methods for scaling growth? I'd love to hear about others' experiences.

.png)