My partners Chris Sugden, Jennifer Lee, Ryan Ziegler, and I are excited to have led a $115M growth investment into Fingercheck. Our investment continues our partnerships with Stepstone and Columbus Capital who both participated in this round. Fingercheck stands out as a premier HR workforce platform tailored to meet the needs of deskless workers, and we believe it’s uniquely positioned to thrive in an expanding market with the backing of both our capital and operating resources. As technology disruption continues to happen across SMBs, specifically in industries like healthcare, construction, and others with key personnel in the field, Fingercheck will be the leading solution for those looking for all-in-one HR solutions.

This investment aligns perfectly with Edison’s commitment to the digital transformation of the CFO’s office, especially in underserved markets such as deskless workers. Our portfolio already includes successful companies like Billtrust (IPO), Bento for Business (acquired by U.S. Bank), COMPLY, Liberty Tax (IPO), Solovis (acquired by Nasdaq), and K1x. We see Fingercheck as a powerful addition to this theme, reinforcing our belief in its potential.

Purpose-Built Technology for SMBs

Fingercheck offers a comprehensive HR operations platform designed specifically for deskless workers in SMBs across various industries, including retail, construction, healthcare, and manufacturing. With modules covering payroll, expense management, scheduling, benefits, time tracking, and people management, the platform simplifies the complexities that SMBs face in managing a deskless workforce. Founded by Joel Kohn in 2013, Fingercheck has continually enhanced its best-in-class offerings.

As an all-in-one solution, Fingercheck addresses the challenges of juggling multiple vendors—most of which do not cater specifically to the SMB segment. After evaluating several HRIS platforms, we found Fingercheck to be one of the most impressive all-in-one solutions on the market. With its purpose-built technology, we believe Fingercheck can capture significant market share from traditional incumbents and bridge the technology gap for businesses using outdated systems.

Targeting an Underserved Market with Massive Growth Potential

Since its inception, the company has been highly capital-efficient and without equity funding. Through bootstrapping the organization, they’ve built a large and sticky client base. Our diligence revealed a tremendous opportunity for Fingercheck to expand into new states with our investment.

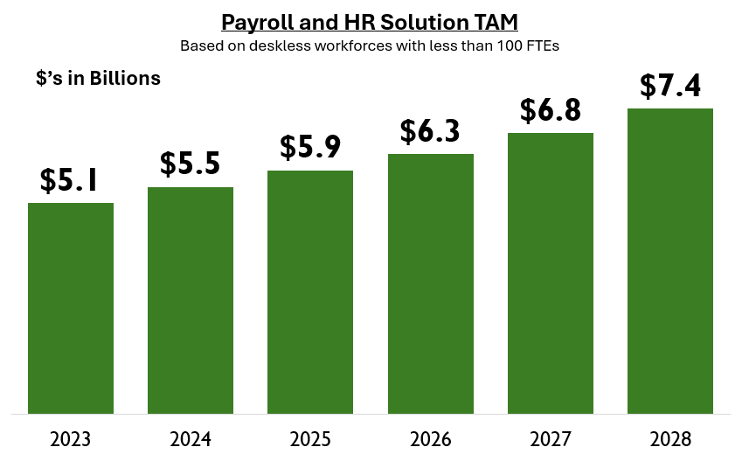

Market research indicates that 80% of the U.S. workforce operates away from a traditional desk, especially in industries such as construction, property management, retail, and healthcare, highlighting Fingercheck's market value. According to market analysts, Fingercheck operates within a $5.1 billion total addressable market, projected to grow at a 7.6% CAGR through 2028, providing ample go-get opportunity.

While many platforms operating in this space experience high churn rates — often due to firms seeking the cheapest options, downsizing, or closing shop — Fingercheck has demonstrated impressive retention metrics. Our analysis shows limited churn and strong performance, even with minimal investment in GTM strategies or significant customer success initiatives. We anticipate significant growth as we enhance this already sticky customer base.

New Leadership Supported by Edison Edge

We are also thrilled to partner with Dan Kazan, Fingercheck's newly appointed CEO. A multi-time CEO — his most recent tenure as CEO of Insureon — and leading commercial insurance broker for SMBs, Dan’s expertise will be instrumental in guiding Fingercheck into its next phase of growth. With Dan at the helm and the added resources from Edison Edge, Fingercheck will experience a multiplier effect in its growth trajectory.

Building on the solid foundation established by Joel, combined with our resources at Edison, we are optimistic about Fingercheck’s potential to capitalize on the substantial $5 billion+ market opportunity ahead.

-1.png)