Growth-stage CFOs constantly strive to balance progress and capital efficiency. It’s a delicate balance, but achievable, as our annual Growth Index tells us that companies growing 30 percent or more annually are able to do so through healthy gross margins, 9-18-month CAC recovery, and strong negative working capital, among other characteristics.

Last month, we gathered Edison company CFOs for our Spring Roundtable to discuss these boulders – the big hurdles to achieving growth and capital efficiency. During the event, four boulders stood out among the rest:

1. Extending cash runway while becoming capital efficient

Wouldn’t it be great if all of your customers had annual contracts paid upfront, and your vendors were willing to wait? Balancing cash is a boulder, as it can be challenging to navigate, accelerate and scale growth while, at the same time, conserving expenses.

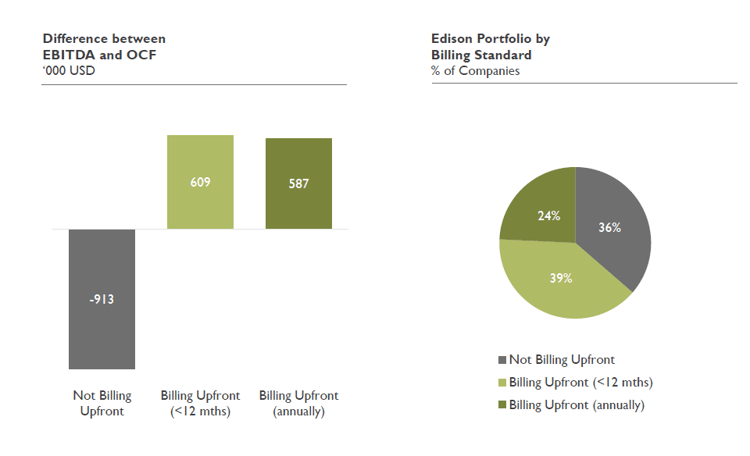

To move the capital efficiency boulder, consider linking sales compensation to contracts and collections. Tying sales compensation to contract terms can motivate your sales team to focus on longer-term pay upfront contracts, versus month-to-month pay-as-you-go contracts. Commissions get paid when contract premiums are paid; therefore, monthly contracts would delay commission payout. According to Edison’s Growth Index, 63% of Edison companies bill upfront, contributing to an increase of operating cash flow vs. profitability.

*Edison companies that bill upfront enjoy an increase in cash, enabling such companies to utilize resources they would otherwise not have access to.

Another way to circumvent the cash runway boulder is through an MRR line. MRR lines are lending products based on a company’s monthly recurring revenue that grows as your business grows, a lever that can help smooth out seasonality and assist with cash flow when payments are delayed. Typically, MRR lines are 3-5x recurring revenue, taking into account revenue retention rates, emphasizing the importance of minimal churn. You’ll also want to consider the risk of guarantees whether based on personal or company assets.

2. To offshore, or not to offshore: that is the question

Everyone wants a hard-working employee at a reasonable price. The boulder is finding them, particularly when it comes to technical talent. Offshoring is a way to reduce labor costs, but there are also tradeoffs to consider, such as quality of product/service, language or accent barriers, and cultural dissimilarities. There is also the added price tag of training and monitoring the offshore crew. Moreover, local labor laws and environmental regulations can add expense if you don’t do your due diligence before entering a foreign market.

To mitigate some of these issues, appoint a liaison to oversee the offshore team. The liaison must have strong product knowledge and an understanding of the company’s strategic goals, as well as speak the local language and be familiar with local customs to relay and achieve objectives. More importantly, the home office should remain in control of hiring to control quality of the function the offshore team is performing.

Cautionary tale: Dell in 2003. The company moved their tech support and customer service units to India with hopes of reducing labor costs. Quality of service degraded significantly. Customer complaints and loss in market share gave the company no choice, but to retract their overseas operations. The old adage applies: You get what you pay for. The lowest bidder doesn’t pay off, if it means risking the integrity of your brand.

3. The blind spot of sales tax

Most CFOs don’t think about sales tax compliance until it’s too late and the state auditor is knocking at the door. Being proactive is essential, but how can we be the authority across multi-state jurisdictions when each state’s Nexus (sufficient physical presence) guidelines vary? State regulations differ based on the type of sale, the dollar value and even who performed the activity; however, the biggest boulder for growth-stage tech companies is the need for clear language regarding digital product sales tax obligation. The world is no longer made up of brick and mortar business; it has transitioned to electronic selling. The issue is that state regulations have yet to catch up, then, just when you think you have it all figured out, the laws change. Therefore, SaaS companies face a greater challenge due to their digital footprint. Steve Forbes hit the nail on the head when he said, "The tax code is a monstrosity and there’s only one thing to do with it. Scrap it, kill it, drive a stake through its heart."

To navigate murky sales tax waters, you should perform a regular diagnostic checkup to assess sales tax exposure. The checkup should include an examination of the tools to track, report and remit sales tax, a Nexus analysis to determine potential tax liabilities in the states in which you do business, and, of course, an analysis of tax information, such as rates, rules and potential exemptions. An important fact to remember is that revenue is not necessarily a good indicator of sales tax obligation; it’s more about how and where the company does business.

4. Alignment

The last and probably one of the most common boulders for CFOs is team alignment. CFOs take on the role of referee as they are tasked with creating and preserving the organization’s objectives.

It’s no longer about just being the financials gatekeeper, but aligning the organization towards its objectives as a strategic and operational decision maker. To be an effective organizational leader, the CFO must direct the productive use of resources by developing strategies for sustainable value creation. For instance, sales and product may be the dynamic duo, but when it comes to who gets allotted budget dollars it can be an all-out war. This point of tension is where the CFO (referee) steps in to determine where funds get earmarked that will drive revenue. Since product and sales are the top expense categories for growth companies, driving alignment between them is important to accelerate growth. One thing CFOs have in their favor is that they bring data to the table, which can disperse the cloud of amnesia that sets in when objectives are not met and the blame game begins. This “superpower” enables organizational accountability by allowing the CFO to monitor progress and react to fluctuations in order to achieve the end goal, growth and profitability.

No matter the stage of growth there are always boulders in the way. Clearing boulders takes proactivity, perseverance and a good solid team.

So, what’s your boulder?