MoneyLion is changing how Americans bank, and it's doing so from the inside out.

Founded in 2013 on the belief that we all get ahead when nobody gets left behind, MoneyLion committed itself to serve the 100+ million people in the U.S. who have long been overlooked by traditional banks. MoneyLion would open access to services that banks typically reserve for only their high-net-worth, private banking customers. This year the company grew its users by 123%. By 2023, the company estimates it will reach 9 million customers with a single app that provides banking, buy now pay later, earned wage advances, credit building, advice, crypto, investing, and more.

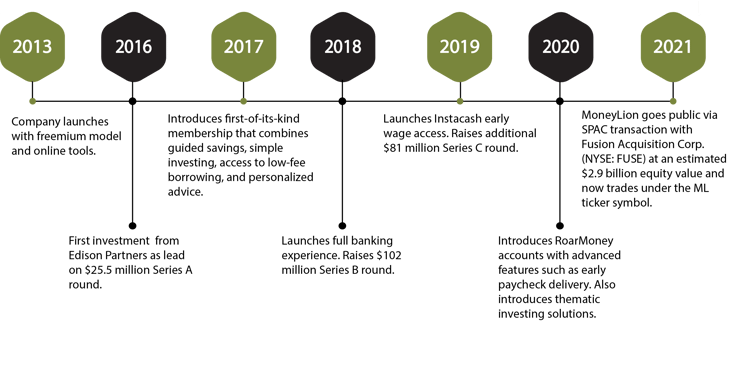

We joined the MoneyLion journey in 2016 and worked with the Company as it evolved from Fintech 1.0 (monoline, transaction-based financial apps) to Fintech 2.0 (re-bundling of complementary products), and now Fintech 3.0, where MoneyLion delivers a consumer financial marketplace at the intersection of money and lifestyle. Throughout, what’s jumped out to us at Edison, has been MoneyLion’s ability to attract customers at their intent cycle, before they buy. The customer knows exactly what they want to do and MoneyLion delivers the individualized content and solutions designed to drive impact in their lives.

Edison Partners + MoneyLion

Edison first got involved with MoneyLion early in its growth lifecycle, leading the Series A round in 2016 and leading the Company’s Series B and C rounds by bringing in our Limited Partners for additional capital to complete these rounds. We continue to be the largest shareholder in the company. But the bottom line is that it was the combination of team, market, product, and business model that got our attention.

The Right Team: Co-founder and CEO Dee Choubey knew exactly what he was going to build when he created MoneyLion, and like many entrepreneurs, brought with him a vision of a multi-billion-dollar legacy by creating a company that would change the game. What has set Dee and his leadership team apart is how closely they aligned and realized that vision with solid execution.

Getting to nine figures in adjusted revenue ($155M 2021E), expanding at scale, and going public are all important milestones in the evolution of a leadership team, but they can also challenge executives who aren’t ready for them. Having grown up in capital markets, Dee isn’t your typical tech CEO. He was trained at the Goldmans of the world and that experience has turned into a major asset for the company. Quite often, dealing with the capital markets as a public company can be venturing into the unknown. Dee understands the need to build culture internally while educating the capital markets.

The Right Market: MoneyLion has already re-bundled the banking experience on an immense scale. The Company’s early slogan was “the private bank for everyone” offering online and app-based personal finance – bill paying, balance tracking, credit score monitoring, lending, etc. – as part of a freemium model.

Today, MoneyLion is an all-in-one mobile banking experience offering access to banking, investing, access to credit and other financial services and tools.

An important element of banking is providing customer access to credit. It’s one of the most difficult to crack as both sides of the equation—the bank and consumer—are critical to success. Following the 2008-09 financial crisis many banks pulled back from offering credit to anyone who appeared even remotely risky, and that created a large gap in the market between the haves and the have-nots that forced many customers to products like payday lending and high-interest rate credit cards. The market is in a very different place a decade-plus later, but many banks and fintechs still haven’t figured out how to offer credit to the masses at rates that make sense for everyone. Conversely, that’s exactly the problem MoneyLion already solves; they created their banking experience by starting with one of the hardest elements, credit.

One of MoneyLion’s additional superpowers is their data, which gives them the ability to predict when consumers have money and when they might run out of money. Based on their intimate understanding of a consumer, the over 14.5 million bank accounts that are connected to MoneyLion, and over $590 billion dollars of transaction volume - MoneyLion can offer customers the optimal basket of financial and non-financial products at the time they need them. They have the database and the understanding of how to underwrite and provide the appropriate amount of credit to their customer. This ultimately extends the customer lifetime value.

The Right Model: Fintech in general is often siloed. You’ve got fintechs and neobanks focused on robo-advisory, others working solely on instant wage access, and still others offering investment access. Each of these niches contains multi-billion-dollar market cap companies. MoneyLion, however, is doing them all at scale, inside one product with world-class technology. The Company’s business model bundles it all together as either a subscription service or a pay-as-you-go transaction model based on individual product access. Consumers interact with MoneyLion much like they do with a delivery or ride-sharing app.

And they’ve done it all very capital efficiently (with a lot less capital) compared to others in the neobanking, payments, trading, and robo-advisor spaces. We like to think that capital efficiency speaks to the skill and scalability of an operating model as well as marketing and product differentiation.

MoneyLion's Growth Journey

The philosophy behind MoneyLion’s evolution was to build one platform centered around the consumer that would house best-in-class, self-service financial products. MoneyLion has everything you would expect from a modern banking experience, along with easy ways to borrow, save, invest, earn, and get rewarded, all in one app. This allows MoneyLion to then nurture customers into different products for different parts of their financial lives.

This strategy has helped to optimize marketing spend and ensure customer satisfaction remains high to reduce churn. The company has seen significant upside from scaling its proven products and strategies, continually penetrating the total addressable market, increasing top of funnel conversions, cross-selling new products via a platform approach and rolling out new products to continue the cycle.

A great example of MoneyLion’s exceptional capital efficiency, especially compared to other consumer-facing fintechs, is the 2020 marketing spend of only $11 million delivering 60% year-over-year user growth. MoneyLion is becoming a must-have tool for every hard-working American, with an expected 3 million customers with financial accounts by the end of the year.

MoneyLion's Long-Term Outlook

At Edison, we believe companies that don’t grow AND evolve, die.

MoneyLion’s evolution from PFM app to a daily financial lifestyle destination and consumer marketplace is exciting. While we are proud to have played a small part in helping MoneyLion get to this point, we firmly believe the team is what makes magic happen. Dee and his team have proven this to be true and then some.

Importantly, becoming a public company is also a key asset in fintech -- adding a new layer of trust for the company with its customers. Public companies report their financials, draw additional regulatory scrutiny, and provide transparency in their business practices. Operating in the public eye helps to convince new and potential customers that the company is well established and trustworthy. These are all material benefits to MoneyLion from brand, marketing, and operating standpoints.

MoneyLion has proven over the years that it is highly adaptable to market demands and is now ready to fully leverage the advantages of being a public company. We are excited to Hear the Roar and see what this amazing group does next. Our congratulations to the team!

.png)