Surpasses 1.2 million members and turns profitable as more families embrace digital payments and e-learning applications

NEW YORK, NY and PRINCETON, NJ (Dec. 8, 2020)— gohenry, a global leader in building healthy financial habits for kids, today announced a $40 million financing round led by U.S. growth equity firm Edison Partners with investment from Gaia Capital Partners, Citi Ventures, and Muse Capital.

gohenry has built a community of more than 1.2 million parents and children who are invested in learning the vital skill of being good with money. The company has doubled its customer base annually over the past six years and, notably, has been profitable since March 2020. gohenry’s mission is to innovate digital banking and payments and revolutionize financial education to help 6-18 year-olds learn good money and financial habits in an increasingly cashless world. The new funding round will be used to accelerate the expansion of gohenry's combined fintech and edtech solution across the U.S., where the company launched in 2018.

gohenry’s mission is to innovate digital banking and payments and revolutionize financial education to help 6-18 year-olds learn good money and financial habits in an increasingly cashless world. The new funding round will be used to accelerate the expansion of gohenry's combined fintech and edtech solution across the U.S., where the company launched in 2018.

“For too long, kids have been locked out of the digital economy and parents lacked the tools to help their children gain confidence with money and finances. gohenry was the first to respond to these needs in 2012 when we launched a groundbreaking financial education app and debit card that truly empowered children. In 2020, we’ve achieved three key milestones: becoming profitable which many B2C fintechs seek, raising $40 million during COVID-19, and partnering with world-leading funds. All three will help us fuel our US expansion,” says Alex Zivoder, CEO, gohenry. “We are proud to partner with Edison Partners, Gaia Capital Partners, Citi Ventures and Muse Capital. Their endorsement allows gohenry to accelerate its expansion and roll out yet more innovations to customers.”

“As category leader in the U.K. and with impressive traction and product market fit in the U.S., gohenry is accelerating adoption in the U.S. and is well-positioned for success here,” said Chris Sugden, Managing Partner, Edison Partners, who led the investment. “gohenry is catering to millions of parents who are looking to raise smart, financially literate children but are currently underserved by existing solutions. We’re thrilled to partner with Alex and the gohenry management team on this next milestone in their growth journey and look forward to realizing their ambitions to improve the financial fitness of kids across the globe.”

Chris Sugden will join the gohenry board of directors along with Dawn Zier, an accomplished CEO and marketing expert, best known for engineering the transformation and growth of Nutrisystem, Inc, as a publicly traded company.

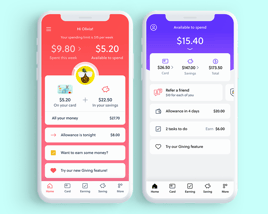

Founded by parents in the U.K. in 2012, gohenry began as a financial literacy app and debit card to inform and empower young people with the education and financial tools they needed to interact with the digital economy. More recently, the company has introduced Teen and Eco cards, all with built-in parental controls, to easily provide allowances and help their children to earn, save, spend and give, while mastering the financial ropes for themselves. Last year alone, gohenry’s young customers earned nearly $150 million in allowances and contributed more than $140 million back into the global economy.

About gohenry

Launched in the U.K. in 2012, gohenry is a money app and prepaid debit card, in partnership with Mastercard in the U.S and Visa in the U.K, with unique parent controls designed exclusively for 6-18 year-olds to help them learn good money habits in an increasingly cashless society. gohenry’s innovative app gives young people the freedom to learn and take charge of their own spending and saving in a safe environment, while the app's parent version allows parents to guide kids through the early stages of digital finance. gohenry is building a global movement of over one million customers who fiercely believe that being good with money is a vital life skill.

For more information please visit gohenry.com or gohenry.co.uk.

In the US the gohenry card is issued by Community Federal Saving Bank, member FDIC, pursuant to license by Mastercard International.

In the UK the gohenry card is issued by IDT Financial Services Limited a principal member of Visa Europe. IDT Financial Services Limited is a regulated bank, licensed by the Financial Services Commission, Gibraltar. Registered office: 57-63 Line Wall Road, Gibraltar. Registered No. 95716.

About Edison Partners

For more than 30 years, Edison Partners has been helping CEOs and their executive teams grow and scale successful companies. The firm’s investment team brings extensive investing and operating experience to each investment. Through a unique combination of growth capital and the Edison Edge platform, consisting of operating centers of excellence, the Edison Director Network, and executive education programs, Edison employs a truly integrated approach to accelerating growth and creating value for businesses. A team of experts in financial technology, healthcare IT and enterprise solution sectors, Edison targets high-growth companies with $5 to $25 million in revenue; investments also include buyouts, recapitalizations, spinouts and secondary stock purchases.

Edison’s active portfolio has created aggregated market value exceeding $10 billion. Edison Partners is based in Princeton, NJ and manages more than $1.4 billion in assets throughout the eastern United States.