In the world of growth-stage companies, finance leaders are also operating leaders. That's because they're known for having the most reliable data and considering it holistically across the entire buyer/customer journey, from prospect to contract and billing to usage and renewal. They understand the importance of maintaining clean data and know that developing processes for this is paramount.

And yet, each business is different. Every company collects its own proprietary data that serves its unique need and application for that information. Leveraging the potential gains from financial and customer-specific data often comes down to having the right systems and processes in place to properly access and apply it.

To address these challenges and share best practices for the transition to a software management platform, Chris Sanders, VP of Finance & Operations with Northpass, an Edison portfolio company that builds customizable workforce learning tools, hosted a session on how companies should be thinking about their financial data systems and making the transition to related software packages/BI tools.

Here are the top takeaways from our session.

The Case for Making the Transition: It’s simple: make the move to a financial data platform as soon as you can and grow into the system. Think about it this way: If you're hiring more accountants to complete manual tasks in Excel you're better off spending that money and time on a system that will help you automate the work. Maintaining your financial information in a central database like Excel doesn’t scale, will cripple your ability to monitor KPIs and tracking, limits cross-functionality, and prevents you from opening up your data to other parts of the organization. And the larger you get and the more information you generate the harder it's going to be to make that switch.

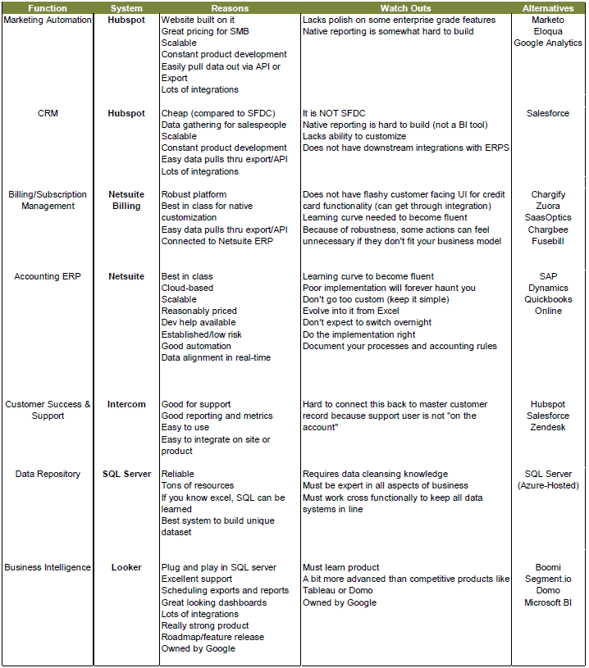

Considerations for Integrating Existing Systems and Data: Once you have your Enterprise Resource Planning (ERP) system set up, with your customer, contract, and billing data all in one place, the next step is putting that to use by linking it to, and through, the data and systems that you already have. Stand-alone platforms all want to be your system of record. Salesforce, for example, encourages users to handle all reporting out of Salesforce, effectively using it as a BI tool even though it isn't one and shouldn’t be used as such. The better approach is to use the tools best suited for each functional area, bringing them together with a BI tool as a centralized source of reporting.

Standardized customer record administration is essential since there's no common delineator that allows you to combine multiple data sets seamlessly across systems. We've all dealt with salespeople who forget to update the CRM, or update things at the last minute or make changes to contracts without recording them, and these can all cause data issues. You can limit that by removing the CRM fields you don't need and identifying all the places each piece of data is going to live. Creating a unique identifier for each customer, which serves as the connection point across all systems, will ensure data integrity.

Before you invest in a software management tool, do your homework, document processes and accounting rules, and invest time and money on implementation. Advance the behaviors of the accounting team to match the automation that best-of-breed solutions offer. And lastly, avoid customization which can be expensive, time-consuming, and break when platform updates are pushed.

Data Analytics, KPIs and the Importance of Clean Data: Once you have your unique customer identifier in place and it is carried through all of your systems, it's fairly easy to pull all your data together to feed business intelligence platforms like Tableau, Domo or Microsoft BI. If you have a developer, you can even do it on your own SQL server using AWS with Azure. With the right data management platform in place, there are many options to bring data together for analysis and utility, but the important part is setting up those keys at the start so that all the platforms can talk to each other.

People vs Automation: The best system is the one that allows you to automate as much of your financial process as possible. Automation ensures data accuracy; it allows you to scale with fewer headcount and dependencies and offload time-consuming manual tasks. Automating your contracts and billing is among the greatest time and cost savers that companies can unlock. It decreases your error rate, improves your visibility into customer profitability, and allows you to publish consistent rules-based results. It also forces you to align your operations around whatever accounting standards your industry is faced with, which benefits you when you go to raise debt, raise equity, or if you're considering an acquisition.

Want to hear more on these topics? Listen to the entire discussion here and download a copy of the data stack referenced in the session.