When it comes to preparing for an exit, getting your financials in order is of utmost importance. How you set up, organize, and present your company’s financials will play a major role in determining how smoothly your next chapter unfolds.

The Role of the CFO

Because company financials are so critical to an exit, we often describe the Chief Financial Officer as the “MVP” of the process. Still, the CFO’s role isn’t easy, and there are common dependencies and challenges that can add undue stress. If your company’s CFO fits with one of the following three common CFO personas, then engaging with a third party (like a sell-side financial consultancy or banker) might be a worthwhile investment.

- The Frankenstein: This describes the CFO of a company that has acquired several companies in a short period of time. They’re likely dealing with incomplete post-merger integration, a disparate data environment, a nonsystematic tech stack, and the like. These challenges make it difficult for the CFO to address simple diligence requests (e.g., producing a streamlined revenue pipeline by product, customer, etc.).

- The Data Disaster: If your company has an extremely complex data environment, then your CFO might fit into this category. Their pain points include insufficient systems, large and unorganized data sets, and/or a management team without the requisite skills needed to extract and manipulate data. Because of this, the management team may be unable to produce reports that are needed during the diligence phase (e.g., an analysis of revenue/profitability by customer cohort).

- The Busy Bee: This is the CFO of a company with an under-resourced F&A team. The management team has sufficient bandwidth constraints, and the understaffed F&A team struggles to keep up with day-to-day activities. With the team already stretched thin, it’s hard to stay on top of daily tasks, let alone manage a transaction without the business suffering in the process.

The higher the caliber of your CFO, the better equipped they and your company are to handle the key financial readiness checklist.

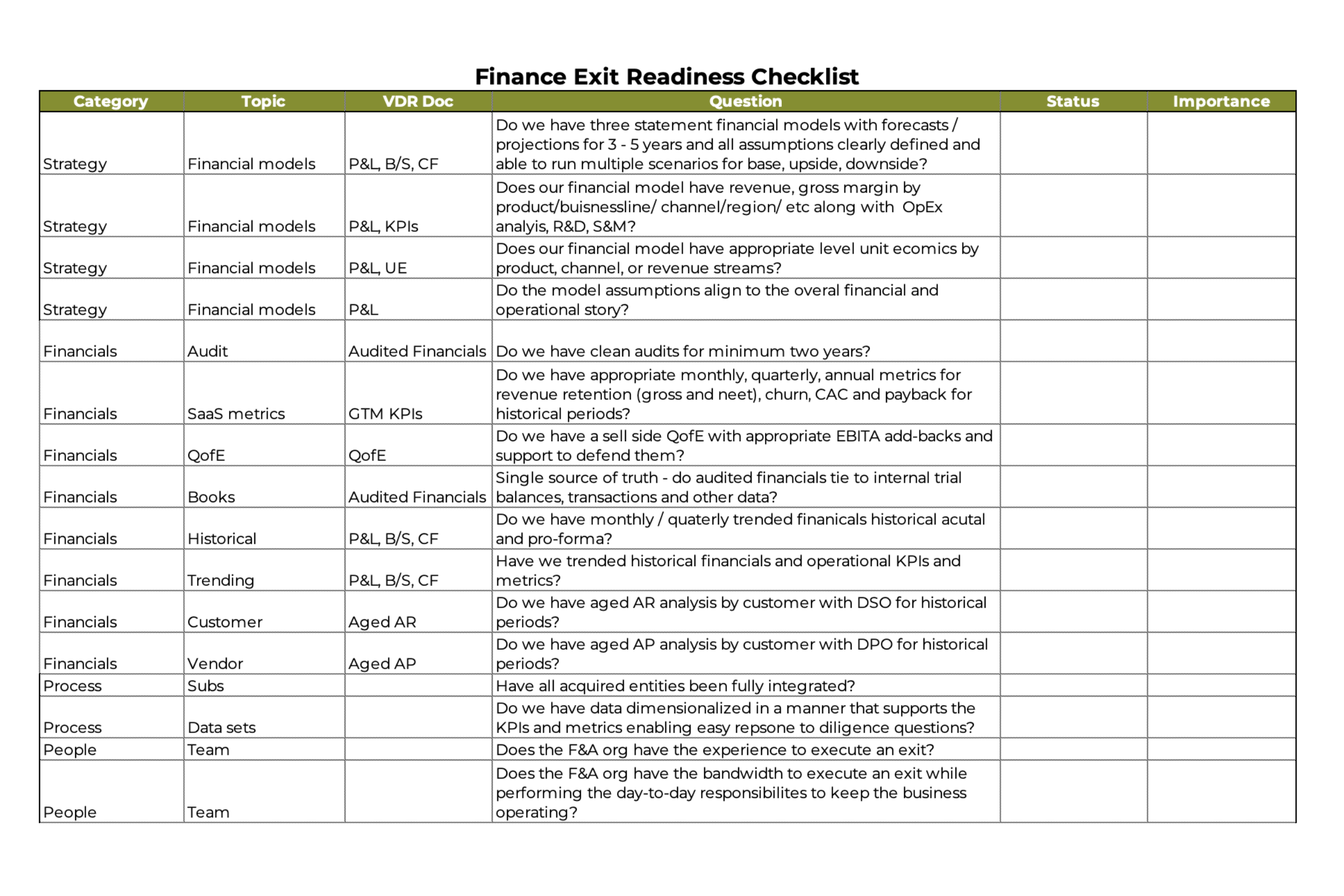

Key Financial Readiness Checklist

To assess whether your financials are ready for an exit, ask yourself the following questions:

- Audit: Do we have a clean audit for at minimum the last 2 years (ideally 3)? What is the Finance Org's ability to produce quarterly financials on an accelerated timeline?

- Merger Integration: Have any acquisitions been fully integrated? For significant acquisitions and public company exits, historical audits of the target may be necessary.

- Systems: Do our systems allow us to create a flexible data cube (including all of our businesses) that can address buyer questions? Can we accurately forecast results, and report earnings, metrics, and KPIs, on accelerated timelines?

- Data Consistency: Do our audited financials tie to management financials, trial balance, and other transactional data? Do we have a single source of truth?

- EBITDA Adjustments: Have we reviewed and prepared EBITDA add-backs to maximize adjusted EBITDA which will improve the business valuation? Do we have details to defend our proposed add-backs?

- KPIs: Do we have historical financial and operational KPIs (including customer cohort analysis) that tell the story of our growth and value creation?

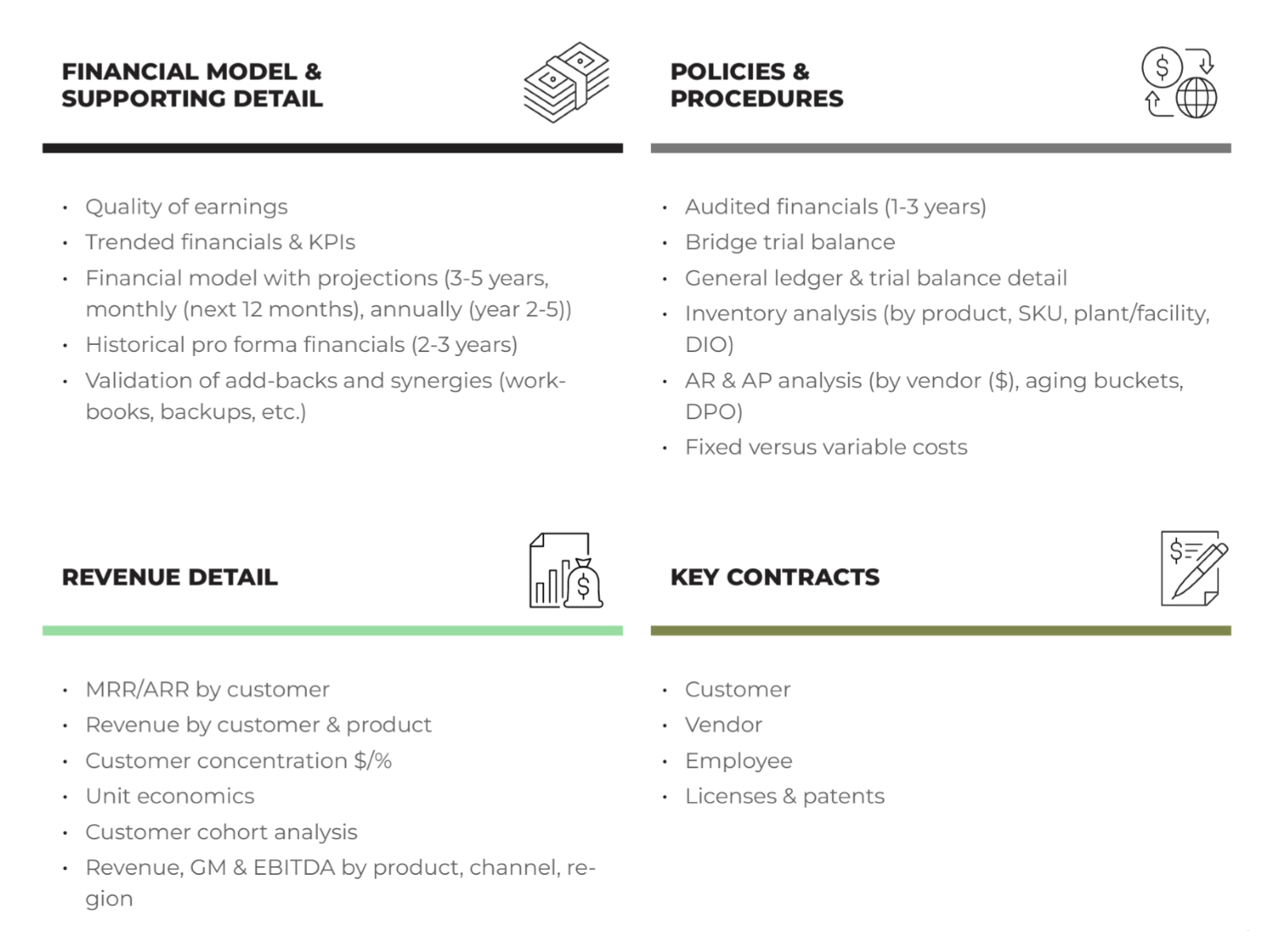

Financial Documents

You should expect to be asked for a variety of financial documents, including your financial model, policies and procedures, revenue details, and key contracts. Don’t wait until you’re in the middle of an exit process to start preparing these. Best practices suggest you should be getting them ready now, acting as though you’re already in the process. For all of these documents, ensure that the financial data has been scrubbed and is put in a printer-friendly format. Verify that any information containing employee, customer, or client information is scrubbed; specifically, it is best practice to blur personal data in background checks which typically contain social security or other unique identification.

Beyond this, be prepared to present tax and procurement documents, including but not limited to:

- Federal & state tax returns/tax provision work papers

- Salaries by state

- Revenues by state

- Form 5500 benefits plans

- Examinations

- Vendor summaries

- Monthly spend by vendors

- New spend approval process

Company financials, models, KPIs, and data can make or break your exit process. To make sure you and your team are prepared, download the exit readiness checklist below.

.png)