As a CEO or founder ask yourself these questions:

- What is the growth plan?

- Are you considering a capital raise or an M&A transaction?

- What are the capabilities of the existing team?

- Do you need guidance and leadership on strategic planning decisions?

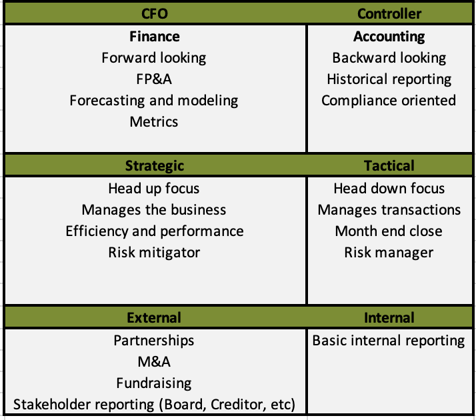

Most early-stage businesses start their finance function with a controller or bookkeeper providing the CEO with basic financial reporting. Some CEOs even do this themselves - but as a business begins to scale, expand offerings, headcount, etc. - CEOs often question “do I need a CFO?”, or “when is it the right time to hire a CFO?”, “will a controller suffice?”. While CFOs and controllers have similarities in tactical guidance, there are also material differences in their roles and impact across the business.

Let’s consider the differences between a Controller and a CFO :

As you are considering a CFO, it’s important to know that there are different types of CFOs. Having a clear strategy towards your growth ambitions will aid in making the right decision regarding the type of CFO you bring in.

Four CFO types:

1. The Steward, this type of CFO focuses on protecting assets of the company. They ensure compliance and control. Their strong suits are: historical reporting, timely and accurately closing the books and mitigating risks. This CFO is similar to a controller.

2. The Operator. This CFO is focused on building and developing an efficient and effective finance organization. They go beyond the historical reporting and are skilled in providing forward looking services of financial planning and analysis (FP&A), metrics reporting, cash forecasting, and other financial operation functions to the CEO.

3. The Strategist. These CFOs take a seat at the table and are active in shaping, guiding, forming and influencing the future growth and scaling of the company, they are performance driven and alignment focused. Providing financial leadership to enable growth and scaling organically as well as strategically. They are experienced in M&A, debt and equity financing strategies, along with driving the long-term vision of the company.

4. The Catalyst. A catalyst CFO is a change agent with an eye on value creation. They focus on execution and drive transformations, process improvements, and bring technology automation to the forefront. They leverage AI and capital to drive value creation through things like enterprise cost reductions, pricing strategies, sales process optimizations, and other process workflow improvements.

We have learned from recent market disruptions, macroeconomic conditions and shifting workplace strategies that C-suite leaders have evolved from their more traditional roles – including CFOs. This includes a shift in adopting data-driven analytics and optimizing processes and systems. The type of CFO you ultimately decide on will also have a value set and integrity that needs to align with your organizational structure and cultural goals, so keep that at the forefront.

Now that you have defined the growth plans, thought through the strategic initiatives that will get you to that next stage – which CFO is right for you?