Entrepreneurs and leaders:

Below is the week six memo that was sent to our CEOs across the country on Sunday, April 12.

------------

In normal times, finance and sales engage in a carefully choreographed playbook to reduce the accounts receivable (A/R) line item. They focus on aged receivables and occasionally there is a requirement for a specific customer strategy. In a black swan, however, A/R payment equals survival.

Last week, I was talking with a CEO and CFO about cash runway and a question surfaced: Is there a good way to assess customer credit-worthiness? The credit-worthiness question is one of risk. And the risk impact shows itself in the A/R line.

Assessing Credit-Worthiness

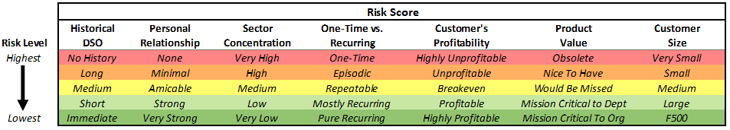

Below is a framework that attempts to capture the inputs you need to assess the credit-worthiness of a customer.

The framework lists seven drivers of credit-worthiness, each of which has its own distinct weight, illustrated by a heat map.

- Historical DSO: The payment track record of the customer appears in the Days Sales Outstanding column. The track record, from no history to immediate payment, can apply to all business models and situations. Your current customer payment pattern will probably get longer and potentially truncated in a black swan.

- Personal Relationship: This is the personal connections across your finance, sales and support teams with your customer counterparts. Often companies will rely on the most senior champion inside the customer to determine viability in the account. It is a good idea now to baseline your current relationship depth from minimal to very strong with each functional counterpart. Moving forward you should monitor and nurture personal relationships across both the influencers and the decision-makers.

- Sector Concentration: We know that some industries are more affected by the black swan than others. We saw this back in 2008, too. List industries as high-risk if they are more affected by the recession than others in your customer portfolio. The hardest-hit sectors are well known at this point. This includes any channel partners you have reselling your product.

- One-Time vs. Recurring: Your business payment model, from one-time to recurring, is an important risk factor too. You can bet that more consumption-based requests are coming versus upfront commitments. Professional service fees will also predictably come under pressure.

- Customer’s Profitability: While difficult to know and not necessary for any F2000 company, a customer’s profitability is a factor of credit-worthiness.

- Product Value: This, in my estimation, is the most important driver on the matrix. Obsolete and nice-to-have products are in trouble in the black swan environment.

- Customer Size: The customer-size segmentation assumes that the larger the customer the more probable the receivable will be paid. IBM or Aetna is far more stable than your SMB customer. Conversely, it may be that some F500 behemoths block payment because they know you need them, while the SMB customer pays net 30. Nonetheless, size matters in a swan and there is a sliding scale of A/R risk with F500 least risky and SMB highest.

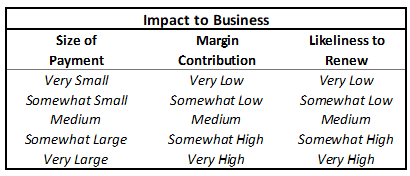

At the end of the chart, append three additional columns, that uses the heat map to describe three impacts to your business.

- Size of Payment: This is from your internal perspective and not the customer. I assume you are employing tactics now including extension of payment timelines, free usage periods and discounts. Everybody is doing this and it is not a differentiator. All customers know its concession time. While there are limited possibilities, the potential for protecting payment via commercial terms is connected most to the perceived product value from your customer.

- Margin Contribution: This focuses on a per-customer basis at the operating margin line versus just gross margin. Often the large customers can be the most expensive regarding cash burn. Product unit economics matched against specific account “cash out and cash in” analysis is required before renewal negotiations.

- Likeliness to Renew: It is common knowledge that it costs 3x more to acquire a customer than retain a customer. This reality is the reason most companies are fencing and fighting first for their installed base.

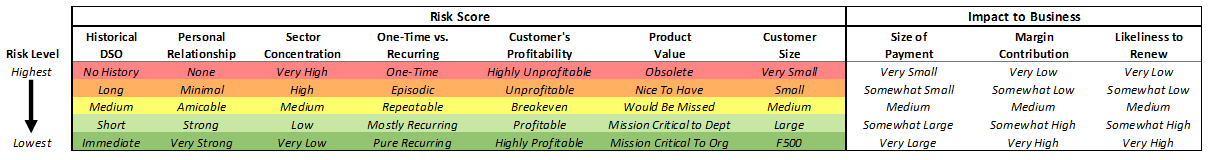

Your completed Framework should resemble this:

Click here for the Excel version of the above framework.

A Call-Out Regarding Product Usage

You are about to get the clearest understanding of the true value of your product in the next nine months. This test will come from your large and medium customers who have the ability to pay. Warren Buffet’s famous quote is: “when the tide goes out you see who has no clothes on.” Or, as I say: “when the swan is in the water, the need to have products swim to shore and the nice to have products get washed up.”

Your finance, sales and customer service teams should have a daily product usage tracker established as a critical feedback loop. Perhaps you have this now but is it wired across all stakeholders supporting the A/R line item? Is it a discipline as natural as closing the books or delivering the roadmap commitments or paying the commissions? The usage pattern becomes the arbiter of renewal or churn. Usage is an upstream metric while A/R is downstream. Upstream things have a wider perch for seeing what is happening in your business.

Interpreting the Results

My view is product value, customer size and sector concentration should be weighted most for A/R risk. For purely a customer credit-worthiness assessment, customer size and sector concentration are the most deterministic. A color scheme was used here to be more illustrative since each of you are different. You could use a numeric scoring system as well. As you can see, this matrix can become a binomial based on all the possible combinations. That is too complicated and unnecessary.

The March accounting books are closed. The terms of net 30, 60, 90 are happening. The first feedback loop from customers is underway in the black swan. This exact matrix might have minimal value but I hope it confirms or catalyzes you to institute a biweekly, multi-department meeting with a standard matrix that captures a full 360 degrees voice of the customer from all your front-line players.

A/R is connected to relationships, reputation, roadmap, retention, return and RESILIENCE.

Many blessings to you and your families,

Edison Partners