Entrepreneurs and leaders:

Below is the week four memo that was sent to our CEOs across the country on Sunday, March 29.

------------

We hope you are safe and sound. Capital markets and government actions provided spring sprouts while we continue to take tough measures and build endurance. I have talked a couple of times about the sliding scale of short-term versus long-term horizons due to the swan. This is causing all of you to make a sudden switch from downstream to upstream decisions for every aspect of your company. The downstream focus was making the sale, rolling out the new product release, hiring ten more people, and planning the flagship event of the year. Your focus on the downstream glide path has been rolling not just for quarters but for years. And then four weeks ago, the violent shift happened.

Upstream actions are now the clear and present clarion call. This is very difficult and highly stressful since upstream success is neither fun, clear, or often even measurable. Upstream work is for long-term impact with no apparent return next month. You are dealing in approximations and trade-offs versus aggregate summation. The questions now being asked include:

- How long do we need for cash runway?

- How will our customers behave on uptake and payments?

- How are the new facts on per user churn or default rates

There are no accolades, PR announcements, or BOD congratulations for this upstream work. Designing and implementing resilience doesn’t get in the WSJ, secure more funding, or pay bonuses. The one thing upstream will do is create a stronger and faster future with a more competitive position when the downstream rivers start running again. For example, you will know in the next three months what the true value is that your product delivers. You will learn where you sit on the continuum of “nice to have” versus “need to have.” Regardless of the answer, your future product roadmap is destined to be delivering more product revenue at higher gross margins in 2021. Your articulation in product marketing is about to become more exact and differentiated. The confidence and the swagger in your sales team will be self-evident.

I thought it would be helpful for you to know what actions are being taken by your fellow CEOs and finance leaders in the last two weeks. Most companies are underway executing serious measures to conserve cash by eliminating all non-essentials. Second, most of you are taking reductions this week and next week where it will hurt most; people, salaries, bonuses, and freezing hires. We have several companies that will grow 15% this year that are still cutting operating expenses 20%.

CEOs are relying heavily on CFOs for truth talk and building a weekly reporting process for revenue, margin, and expense impacts. Some of our companies are doing daily reports. I recommend you have a daily tracker for product usage, deployments, demand gen funnel yield, and requests for discounts and deferments to revenue. For B2C, it is crucial to track daily subscriber acquisition, usage, and whatever indicator is the gold metric for churn.

Actions to Build Resilience:

- Revenue: Companies are reducing their forecast between 15% to 50%. The most common decrease is 30% for the rest of 2020. I find it curious that the cut is coincidentally on par with the market drop. This is the same assumption for companies in the Valley too. Revenue impacts can be much worse than the decrease in capital market valuations.

- Bookings: Companies are reducing their forecast between 15% to 70%. The most common decrease is also 30% for the rest of 2020. A field-based sales model coupled with customer concentration in the hardest hit verticals should be on the north side of 60%. Your ASP size, sales cycle length, and number of approvers are highly deterministic during swan and post swan for many months. A 12 months sales cycle in good times will not become a six months sales cycle in 2H’20 – for most.

- Churn: This is the most scrutinized line item and with good reason. The gross margin of the installed base supports the operating cost structure of the business if new bookings do not happen. It also assumes timely cash payment. The range of reduction across companies is 25% to 70% in some cases.

- Operating Expenses: The range of reduction is 15% to 35% depending on the size of the company. Many companies are in the multi-million dollars range of reductions. All discretionary spending is halted, hires are stopped, headcount reductions are occurring, and annual compensation (increases, bonuses) is being cut. We are seeing some CEOs starting to re-assess and be more aggressive now out of concern and fear of needing to do iterations of cuts.

- Rent: We are seeing examples of rent being waived for the following month, particularly in high infection areas.

- Debt Lines: Some are taking down all possible debt while others are ensuring its available but not taking it yet. We think it’s a good idea to take available debt and be disciplined about using it.

- Other: Finance teams are increasing their intensity on Accounts Receivable risks. Scrutiny includes assessing no payment, delays, and aggressive discount requests. We have some inbound inquiries about this and will provide an accounts receivable conceptual risk framework under separate cover.

- Cash: Most companies are taking actions to ensure 18 months of cash runway. About two weeks ago the thinking was 12 months. I wrote before about this dynamic of a split-screen negative duality; waiting for a peak virus and trough market. An 18 months cash runway might effectively become 12 months or less from today when we cap the peak and the bottom.

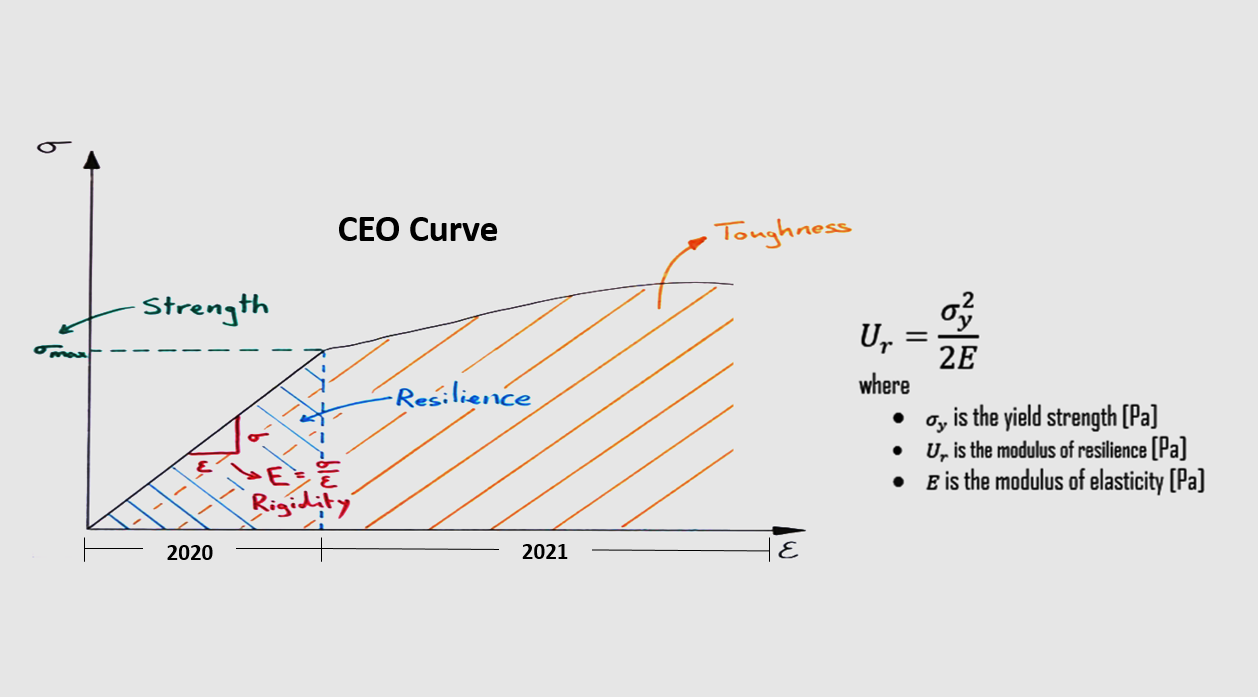

Find your resilience formula. Implement up and to the right. This will transition to steady state toughness. Then the resilience slope will get replaced with a revenue growth slope at the same angle, up and to the right.

We are here 24 x 7.

Sincerely,

Edison Partners