The Lighthouse Series features a weekly Q&A where we ask five simple questions to one of our portfolio CEOs. These questions are matters of the heart, mind, and business.

This week, you will hear from a person who has faced adversity with a tough inner core, strong operating principles, and a market point of view that translates into aggressive and timely company actions.

THIS WEEK'S CEO: MILIND MEHERE

Milind Mehere is an award-winning entrepreneur with a track record of building large scalable businesses and creating new product categories. Milind is the Founder and CEO of YieldStreet, a digital wealth management platform focused on income generation. In 2020, YieldStreet was named Financial Times' 12th Fastest Growing Company in the US, and in 2019 was named Inc 5000's 14th fastest growing company, #1 in NY, and # 1 in Financial Services.

Previously, Milind Co-Founded and scaled Yodle (an ad-tech platform for SMBs) to $200M+ in revenue and 1,400 employees. Yodle was ranked four times in the Inc 500 list and was acquired by Web.com for $342M in 2016. Milind was named an Innovation Fellow at Columbia University's Lang Center and is an international keynote speaker, having spoken at Forbes, Bloomberg, Cheddar, LendIt, Citi Bank, Goldman, Columbia, and Harvard, among others.

1. Now that we are 11 weeks into the swan, what has been your biggest learning?

My biggest learning has been to remain calm and not get sucked into the herd/fear mentality. In speaking with advisors and other entrepreneurs in the early weeks of COVID-19, it was easy to get caught up in the hysteria. “This company is laying off X% of staff and this company is predicting y% negative growth.”

Yes, there are many companies that have needed to pivot, change strategies, or lay-off staff as a result of COVID-19, and Yieldstreet experienced some challenges of our own too. But we’re also showing early signs of being a strong multi-cyclical platform. We’re lucky to have a resilient business model and recurring revenue, even during a dislocation like this. We believe a platform like ours is needed more now than even just eleven weeks ago.

All companies, including Yieldstreet, will face challenges over the coming months, but it is critical to remain calm and not be reactive.

2. You have a bold vision. How have you had to adjust your message or strategy to the team and marketplace?

Yieldstreet was built to help millions of people generate consistent passive income to get on a road to financial independence. We do that by providing access to alternative investments across a diversified set of asset classes previously unavailable to most.

Our true north has always been to connect investors to high yield alternatives through a simple, transparent platform. Our mission and true north remain the same despite COVID.

We’ve found that during these difficult times, reiterating this to our now dispersed teams has been hugely important. We’ve been hosting weekly “Word on the Streets” (30 min, all-hands meeting like Google’s TGIF) to stay connected and reinforce our mission and goals.

3. Has there been any positives due to WFH?

For me, personally, there are fewer distractions and more space and time for “deep work.” Many of our departments were used to collaborating remotely because we have teams in South America and Europe.

I do, however, miss the face-to-face interactions and collaboration that cannot be replicated over video.

4. What did you learn in the 2008 financial crisis that you are applying today?

This too shall pass. There’s a portion of our staff who are experiencing this for the first time in their careers. There’s also another portion who’ve experienced downturns once or twice before. We know that just like before, we will collectively get through this.

During the 2008 crisis, my former company Yodle was scaling. At a time when unemployment was very high, Yodle was still hiring aggressively. As an immigrant to the United States, I was incredibly proud to contribute to the economy and create jobs across four states: NY, NC, TX, and AZ. I believe and hope that during this downturn, we can do the same at Yieldstreet.

Separately, for a while now, many have predicted a market correction. Though we admit, we didn’t know it would come so unexpectedly and because of a global pandemic. We firmly believe, however, that this downturn will bring opportunity to the Yieldstreet investor community. It’s not going to happen overnight, but we see it on the horizon.

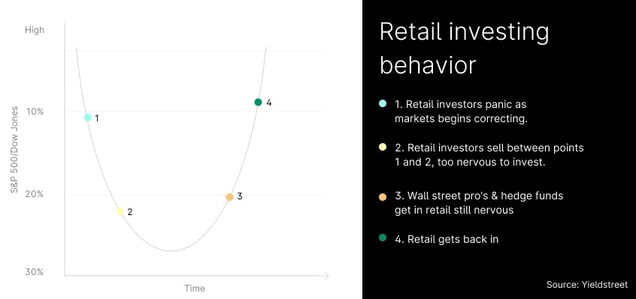

Take a look at the graphic below that illustrates what could happen to retail investing during times of crisis:

Does this behavior look familiar? Points 2-4 present an opportunity that retail is generally too nervous to take. This is where Wall Street pros have made big bets and won.

Though the current state of the market has created an anxious environment, Yieldstreet was founded and built specifically for uncertain times like these—allowing you access to non-stock market investments that are priced attractively with risk-adjusted returns. Many retail investors have demonstrated such behavior, selling low and waiting too long to jump back into the market, while the legends on the street generate great wealth like John Paulson, Steve Mnuchin, and Howard Marks during the 2008 crisis. The truly great investors like Warren Buffet and John Bogle understand that at times of market volatility, there can be incredible opportunities for further wealth creation.

5. How do you sustain yourself on a daily basis?

Candidly there have been days when I’ve felt like I’m running on fumes. It’s times like those when I know it’s time to get back to basics. Sleep is critical, so I’ve been working on getting more. I also make sure I’m eating well, practicing my daily meditation, and going for runs a few times a week (in a socially distant manner, of course).

I’m also refueled by video conversations with my family as well as “sacred time” with my cofounder, Michael Weisz. We use our “sacred time” to take a step back and think strategically.

And, contrary to the funny memes on Instagram of everyone’s alcohol consumption going up during quarantine, mine has actually gone down. I’m following a strict, “only on the weekends rule,” something that was much harder to implement a few months ago with so many events/dinners during the week.

Finally, and importantly, I stopped watching and reading the COVID-19 news all the time (though I still read industry/financial news). I selectively and intentionally check every few days to see what trusted sources/models are predicting, but have found the non-stop Coronavirus news cycle to be draining and distracting.