Like other key functional areas of your business, your go to market (GTM) organization has a significant role to play in overall exit readiness. Potential buyers want to see a sales and marketing strategy that will support your company's smooth transition during a sale; they are looking for strong market presence, a refined value proposition, and indicators of steady growth and scalability as evidenced by solid performance against key performance indicators (KPIs). Overall, driving go to market exit readiness means using data to tell a powerful story of market opportunity and efficiency.

A well-crafted GTM narrative should answer: What is unique about the way this company captures market demand? What proof do they have that they can sustain and scale growth? Perhaps most critically, how does the current and future GTM strategy directly contribute to revenue predictability and enterprise value? Use these answers to frame your GTM department as a core driver of valuation, not just a cost center.

Ideal Customer Profile: The Foundation of GTM Readiness

At the core of your GTM exit readiness story is your customer. Buyers want to know that you know who you’re selling to and that you’ve developed your sales and marketing strategy with this person in mind. This is why it is so important to have a well-defined and proven Ideal Customer Profile (ICP), as this is a baseline indicator of predictable growth.

When you align your GTM motions with ICP insights – firmographic, technographic, and psychographic data – you are better equipped to drive efficiency and maximize valuation. In fact, companies with clearly defined ICPs see a 30% improvement in return on Sales and Marketing spend, are 67% more likely to exceed sales targets, and have 68% higher win rates. All of these metrics signal to potential buyers that your go to market organization is strong and ready for an exit.

All of this to say, if you are gearing up for a transaction and are not yet clear on your ICP, that would be a great place to start.

Articulating the Market Opportunity

Beyond defining your ideal customer, you’ll want to demonstrate a strong understanding of the market opportunity. Investors care about more than just your total addressable market, serviceable addressable market, and serviceable obtainable market (TAM/SAM/SOM). They also want to understand:

- How urgent is the problem your company solves?

- How well-positioned are you to own and retain (“moat”) a meaningful share of the market?

- What opportunities exist to unlock future growth?

To tell a strong story of market opportunity, articulate how your go to market motion both captures current demand and expands market opportunity over time. This means showcasing a repeatable sales process, demonstrating efficient pipeline growth driven by marketing and sales alignment, and reflecting organizational scalability. Reinforce your narrative with KPIs such as forecast accuracy, retention, and new logo health, which demonstrate predictable revenue generation, pipeline visibility, and sustained traction within your ICP.

Also critical to this part of your story is your company’s differentiation within the market. Potential buyers want to know why you’re winning deals over your competitors. It is the go to market organization that articulates the uniqueness of your company’s positioning and how you bring distinct value to customers. Ensure that you have a solid competitive intelligence program and can show potential investors how and why you are different, incorporating examples of recent competitive wins.

Finding and Executing the Right Accounts

A strong ICP and market opportunity analysis set the stage for potential investors and buyers, but they also want to see evidence of execution discipline in the way you target accounts and develop your pipeline. Account segmentation allows you to focus resources where they will have the greatest impact. Buyers want to know:

- What system do you have in place to identify high-potential accounts?

- What strategies are you using to drive customer acquisition and expansion?

- How effective and efficient is your demand generation engine?

To answer these questions, showcase demand generation KPIs like sales cycle length, win rates, and customer acquisition cost to lifetime value ratios. You might also consider sharing customer stories and case studies that demonstrate efficient pipeline conversion, revenue expansion of existing accounts, and tangible go to market improvements over time.

Painting a Picture of the Future

Finally, potential buyers want to get a sense of the future of your go to market organization. They might ask you things like:

- If you had an influx of capital, where would you allocate it for the highest yield?

- If money were no object, how would you uplevel your go to market organization?

- How will go to market investments translate into predictable revenue expansion?

In essence, they want to know that any money poured into the organization will be put to good use, and that you’re thinking carefully about the future growth levers needed to scale. Highlight areas like sales efficiency improvements, demand generation scaling, and go to market experimentation. At the end of the day, buyers want confidence that your revenue engine won’t break at scale.

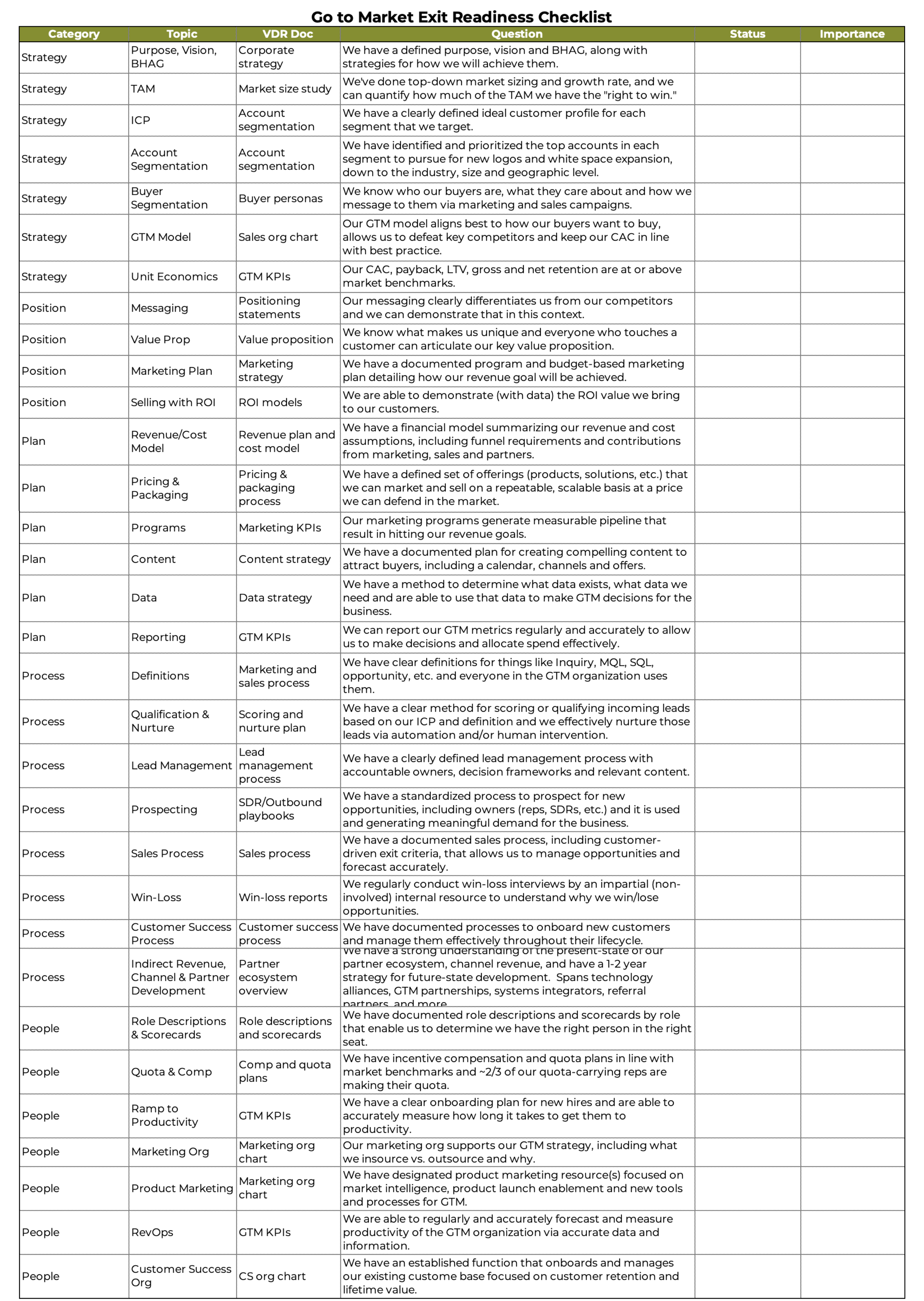

Your go to market story plays a significant role in your company’s overall exit readiness. Proactively refining your GTM strategies well ahead of a transaction can help maximize exit potential. If you’re looking for practical steps to take in advance of the process, download our go to market exit readiness checklist.

.png)