When I joined Edison Partners last year I was happy to take on an interesting project – building an analysis of CEO performance that would eventually become our CEO scalability index. Last week, it was a privilege and an honor to present that same index to some of our CEOs as well as independent board members at Edison’s Director College.

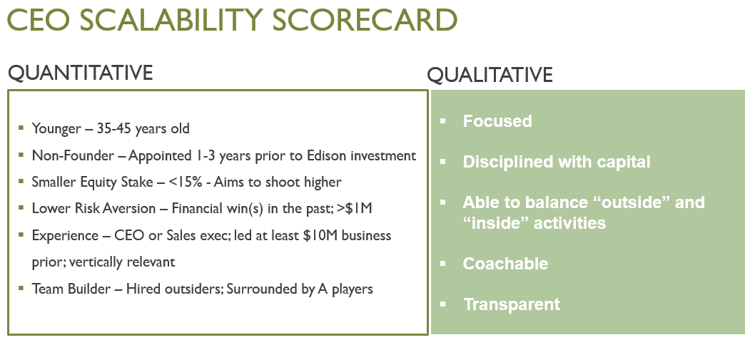

At our stage of investing, we define “scalability” as whether a CEO has the ability to scale the company to a successful outcome. We firmly believe that the jockey is as important as the horse, so we created the Scorecard to help us make more informed decisions pre-investment. Based on historical data points from Edison VI and Edison VII, the analysis seeks to answer two main questions:

1. What qualities do our most successful CEOs possess?

2. Are these qualities predictive of future results?

We were able to develop insights about CEOs that scaled and those that didn’t, consolidating over 30 criteria into a simple scorecard. Here are the characteristics and qualities of successful Edison CEOs:

QUANTITATIVE

-

They are younger, typically between 35-45 years old

-

They are non-founders and get appointed to CEO 1-3 years before Edison gets involved

-

They have a smaller equity stake than founders

-

They have a lower risk aversion and have had a financial win in the past. Such CEOs have earned enough to not be concerned about the downside, but they are also willing and able to take appropriate risks to get to the next level

-

They are experienced. Previous CEOs are best, but they are closely followed by individuals who have at least had a sales leadership role

-

Last but certainly not least, they are team builders. While more of a qualitative element, the capacity to hire well is a major factor in a CEO’s eventual success

While these data points are easily measured and form an important part of our investment analysis, discussions among the internal team often focus on a complementary set of qualitative benchmarks:

QUALITATIVE

-

We seek CEOs who exhibit focus and will not scatter their bets. Focused CEOs have a plan, they stick to it, and they modulate appropriately.

-

Discipline with capital is similar to the above but includes the importance of relying on a good CFO to help with operating and capital finance.

-

Perhaps my favorite one, the ability to balance “outside” and “inside” is great to see. It is rare that a CEO can fill both an extroverted sales role and an introverted management role, but those who succeed usually understand their own strengths and can lean in on their team for help.

-

Coachability is always a plus, but at Edison we seek a balance. Great CEOs understand that they don’t have to listen all the time. We want people who bring great ideas to the table, but still make sure that the best idea wins.

-

Last, transparency – we expect CEOs to make us their first call for both the best news and the worst.

At Edison, we strive to be candid and transparent – refreshingly and uncomfortably, so we took this opportunity to share with our CEOs, exactly how Edison thinks about them. We recognize our findings are mostly directional – we have many outstanding CEOs who do not fit the quantitative metrics described. At the same time, we believe by working together we can achieve great results, and in the end, that’s what matters most.

More to follow in my next blog highlighting key takeaways from the Director College Panel in the upcoming weeks.

.png)