Entrepreneurs and leaders:

Below is the week three memo that was sent to our CEOs across the country on Sunday, March 22.

------------

It has been another week of trying to find the market bottom while simultaneously trying to get the virus to peak. It looks like we are weeks or more away from this split-screen downside reality. I will start by saying call me anytime to talk for ten minutes, even if we don’t know each other. We are here and open for listening.

In the current situation, it is premature for a clear right answer for your business. This connects with the reality that we have limited control at the moment. A lack of control, coupled with a shifting definition of “short-term” are two systemic, anxiety-producing challenges working at the same time.

The Role of Questions:

After a couple decades of working around the world in companies with 100 people or 300,000 people, I think the difference between success or failure in business is asking the right question especially at the right time.

This applies in any role or capacity within an organization, but it is tantamount for a CEO and a Board member. The other wonderful thing about questions is they offer complete control. You own the questions you ask, including the intensity, repetitiveness, variation and who you ask. As a CEO, I often found it my highest privilege even more than authority. Questions are perhaps the most effective counter weight you have for risk mitigation or opportunities in this dual demon of uncontrollability and an indeterminate timeline. Dare I say, you might even find positives, hacks, innovations, culture boosts, and efficiencies. It does not need to be all about risk mitigation and defense.

Three questions I liked to ask my teams, which then filtered across their staff meetings and circled back to me the following week:

- I wonder if…

- Maybe we could try...

- If it works what do we get and if it doesn't work what is the harm...

So, what are we all trying to actually do now?

We are trying to create a model and process for RESILIENCE. In the last ten years, there have been a great many books and speakers about a growth mindset, brain plasticity, adversity and grit (i.e. Angela Duckworth, Carol Dweck, etc). You need all those things, of course. But the call to action now is modeling how to design and implement resilience for your business over the next 18 months – perhaps a year to 18 months is the new definition of “short-term” in this black swan maelstrom.

Resilience accepts that problems happen. Resilience assumes difficulty has hit you in the face. Resilience is about recovery and bouncing back. Resilience is nylon that stretches and returns to shape. It is the engineered bridge welded with iron ore strength for 100 years and yet bends with a hurricane force. It is buildings that are immovable but have springs to allow the covalent brick and mortar to shake during violent earthquakes along the ring of fire.

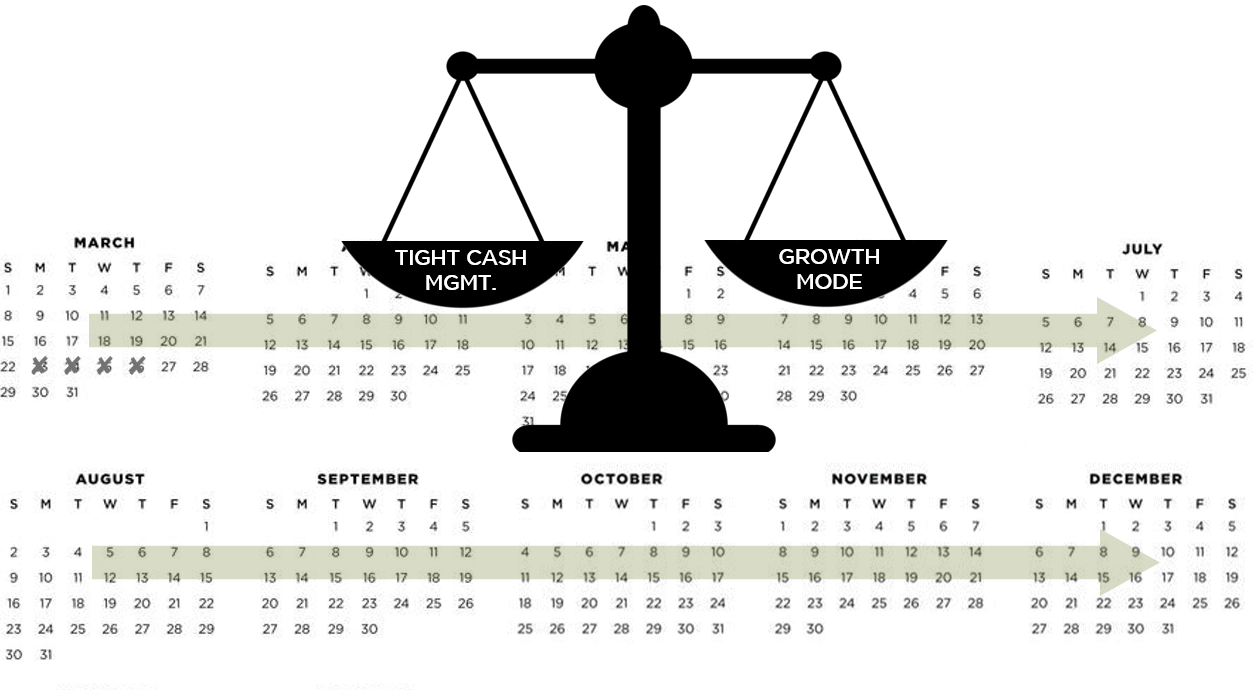

Resilience requires both out of the box thinking (see three questions above) and steadfast discipline. This week we produced a webinar for your finance teams titled: Cash Management in the Waters of a Black Swan. We provided a 13-week rolling cash management tool, a macro context, advice on capital strategies, and comments on the human dimension between CFO and CEO.

The three key points were:

- Cash = resilience

- Realistic, pressure-tested assumptions across all inflows and outflows at a detailed level for a rolling 13 weeks is the best way for Finance to build resilience

- It is critical to have a fact based, sometimes uncomfortable relationship with your CEO

We are very sensitive to looking preachy or authoritative at a time like this. This might be helpful or not, but something beautiful happened during that webinar. Phil Salopek (CFO at Bricata) offered at the end to reach out to all the finance leaders in the portfolio and host a bi-weekly forum, without Edison. There were multiple attendees endorsing this idea within 10 seconds. They want to compare weekly sales activity, expense measurements, etc.

Sincerely,

Edison Partners